There's a bunch of crazy energy out in the world recently...

The CDC just removed all their nonsense COVID-19 guidance rules. Funny how everyone was like, "You gotta listen to the CDC they are professional experts they know what they are talking about," but then when they relax protocol everyone freaks out and thinks we still needs lockdowns and shit. Both my girlfriend and my roommate are freaking out over it, basically overexaggerating they're going to end up dead (both vaccinated) because the CDC magically doesn't know what it's doing but they totally did before. The psychological effects of our response to COVID-19 are nothing but astounding (on both sides of the spectrum).

But how does this relate to the markets?

I don't know... there are just so many things out there that seem to be signaling reversals. Supply chains are getting logged with products and we very well may flip from strong inflation to strong deflation (not better but still a flip). Think about it. Think about how screwed people who manage logistics have been due to COVID and sanctions against Russia.

The Just-In-Time business model of never stockpiling product has failed miserably during all of this, and now there's going to be a snapback fishtail event in the other direction that might be even worse than the disruptions in the first place. Of course that's only bad if you work at one of these companies (and wages and the job market in general). The rest of us are going to be privy to the most epic Black Friday the world has ever seen come November.

CPI data

Finance bros are reading hard into the fact that the year-over-year CPI was like 8% while the month-over-month CPI was around 0%. This is another potential signal that things are going to flip. If the FED starts easing because the data shows they no longer need to raise rates, once again we see that Bitcoin has the chance to make a crazy run up. The dollar could lose value (institutional hands dumping it), but the purchasing power of it can still go up because all the supply chains are logged and need to unload their goods. Of course food might still be expensive. The difference between essential and non-essential products is huge at this point.

Gas

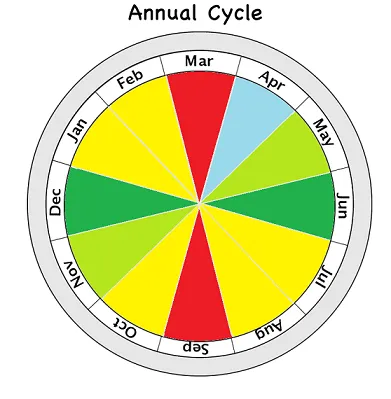

The price of gas always goes down in the winter. It will be the lowest in January and February when everyone is fully broke and tapped out from Christmas and the New Year. I'm guessing the price of gas is going to drop like 25% or more. Again, the price of essential products going down means more money to spend on other things. Keep stacking those sats.

Even my Twitter feed.

Yesterday I was just spooling through my feed like I sometimes do (not sure why... fuck Twitter), and man, wow, the posts were just nuts. There's just some crazy energy out in the world right now. I can feel it. My girlfriend said the same thing, called it full-moon energy, but damn it's so much more than that. There's a major shift on the horizon.

Bitcoin is knocking on $25k for the forth time since the crash. Two of those occurred during the last few days. We seem to be spring loaded to move up considering we just started a bullish 2-week cycle. Market has a way of crashing a little right when I write these things, but at this point I think the lowest it goes is $23k or maybe $22k at the worst. With that in mind... is it really worth it to wait for a potential 10% discount when the doubling curve resistance is like $40k? I think not. I think I'm gonna have to buy me some Bigcorns here pretty soon before we spike up over $25k and I get a wicked case of the FOMOs.

My cycle chart has been comically incorrect since we broke out to $40k from $10k in 2020. September isn't gonna be a bad month. The crash came in June. All the moves have been delayed by that ninety degree three month cycle. If the FED begins easing in September, we very well may get a bull run that appears to last 6 months. Of course that's in retrospect because obviously no one will say we were in a bull market in June when we crashed to $18k until the bull market comes and we trace it back to that local bottom. Remember everyone talking about $10k BTC? Comical. Happens every damn time. Bears would make so much money if they just stuck to the plan.

If all goes according to plan, we could make it to $50k by the end of the year, and that's not even a bull market, that's just a return to the doubling curve (which most people think is the boring price when we are traveling on top of it). Funny how that works.

A real bull market takes us x2 to x3 the curve (often x2.5).

In order to have a real bull market that justifies taking real gains off the table? That would require a price of Bitcoin of around $90k-$150k by the end of year. Obviously those are insane numbers considering the situation we find ourselves in, but it's still the best metric I've got.

Even the fear & greed index is reversing even though we've already been to this $24k level multiple times. The numbers are in: people feel comfortable buying in at this level now that the market has stabilized a bit.

Conclusion

Can you feel it?

The air is charged.

A reversal is coming across the board.

Send it.