Hive as you all know has its own innate stable coin, the Hive Backed Dollar, or HBD. Ideally, this token should always trade for $1, however, it tends to fluctuate around that figure (usually slightly below). Sometimes, however, it can go off significantly in either direction, as seen last week with the recent market crash affecting the whole crypto market.

Towever, the HBD right now is keeping its peg quite well despite this market turbulente, which is a positive sign of strength and important utility to Hive apps and users.

In this post, I want to try and help you understand why the HBD briefly fell like it did, despite being a stablecoin, and how you can use that information to make better decisions about how you handle your HBDs going forward.

But first of all, it is really good to see that despite the heavy turbulence in the market, we now see the HBD back very close to $1. This is great for HIVE for many reasons and seeing it there now should be seen as a positive signal of things working well.

Second, it is important to understand that while Hive has its innate mechanism to maintain this peg, the HBD is still a cryptocurrency like any other that can be moved significantly by irrational trades in the market. We’ve seen this when its value has soared way above $1 up and above $2. As it did in March last year. Thus, while there are reasons why we can expect it to be close to its peg on average over a medium period, this is never certain in practice. So take into consideration that there is always some risk of variance beyond what reason would have us expect. That said, the built-in mechanism will make it increasingly expensive for agents in the market to keep it far from its peg in the long run, thus making it fairly safe (by crypto standards) to assume that it will eventually go back.

Understanding how the HBD works

I will explain more deeply why the HBD went briefly down ~10% with the rest of the crypto market in the next chapter, but since many of my new followers likely don’t funny understand how HBD works, I’ll give a short intro here. If you’re well aware, but curious why it fell and why that’s understandable in markets like we’re in, then feel free to skip on.

As implied by the name, the “Hive Backed Dollar” is, of course, backed by HIVE. This means that at any point, one can hand over HBDs to the blockchain in exchange for HIVE tokens. To have a value of $1, the blockchain gives you one US dollar worth of HIVE tokens per HBD when you use the convert function in the wallet. But how does the blockchain know how many HIVE tokens “one dollar worth of HIVE” is equal to? The Hive witnesses, including the witness that I and @howo run jointly @steempress, pull this information from the market to update our own “price feeds”. The blockchain then takes the average price from the last 3.5 days to figure out at what price it should consider HIVE when paying out a dollar worth of it. The blockchain also use this same mechanic to determine how much HBD it should pay out in post rewards to an article after 7 days. This is why the displayed post rewards you see on your blog posts typically have a day or so delay before changing its displayed value when there is a significant price movement in either direction.

In other words, when the price drops 25% in a quick market crash, the blockchain still looks at the average price from the past 3.5 days when considering the value of HIVE. This means that in the event of a sudden drop or spike in value, it will take 3.5 days for the blockchain to consider the value of HIVE to be at the new level (assuming it then stays relatively stable and doesn’t quickly correct back up or down). During those 3.5 days, the value will steadily move towards the new price, as the new price will make up a greater and greater portion of the past 3.5 days. At first, this mechanic may seem poor or unnecessary. Why wouldn’t we want the blockchain to consider the real-time value of HIVE instead? The answer lies in the high volatility. Imagine if someone placed an absurd sell order on an exchange and caused the price of HIVE to suddenly crash down to $0.1 for just a few minutes before recovering. Should your post rewards then be subject to seeing its rewards reduced by almost 90% just because payout happened while the price was artificially low? How would this allow people to abuse the mechanic by manipulating the market? By taking a 3.5-day average, Hive is both protected against such abuse and users get a more reliable experience. But as we’ll soon see, this also means that the HBD will likely see brief drops whenever there are significant falls in the crypto market and Bitcoin in particular.

Understanding the recent HBD drop and recovery

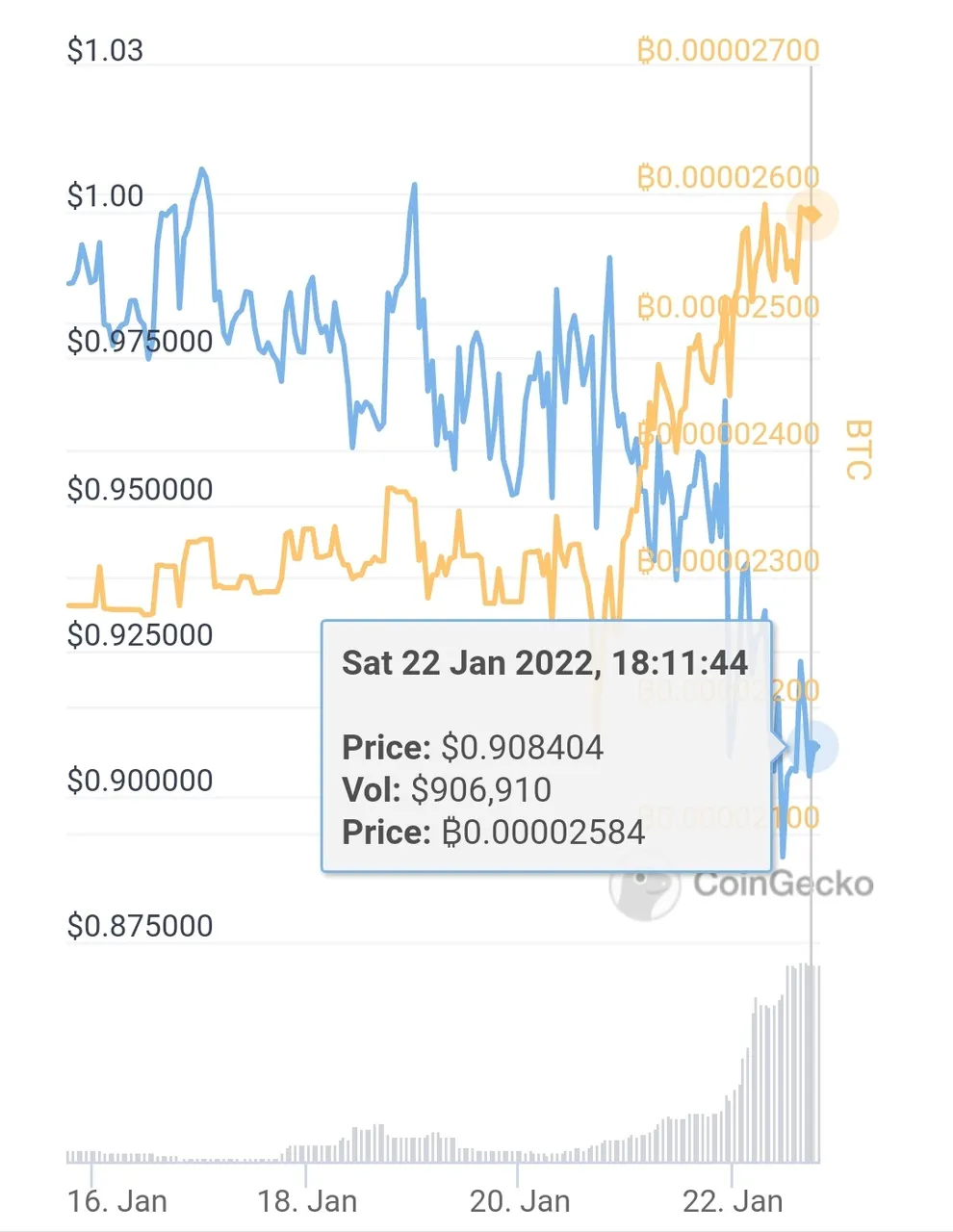

So when the whole crypto market recently saw some harsh drops, seeing the price of Bitcoin fall from $42k to $33k in a short time span, the HBD also went down ~10% before slowly climbing back up. As written in the intro, the idea scenario would be for HBD to always stay close to $1, and as a stable coin that will likely return to that value, why should it be influenced at all by the drop in the market?

First, HBD is mostly traded against Bitcoin on a few exchanges with relatively low volume. Thus, if the price of Bitcoin suddenly falls, the price of HBD will fall as well until someone decides to buy HBD with their Bitcoin to increase its value against it on those exchanges. Second, HBD still has some innate risks tied to the value of HIVE, which may cause some hesitancy when the market seems to be in a free fall. Third, the seemingly free arbitrage that HBD provides when below $1 is still dependent on future volatility and price movements of HIVE.

Seeing as HBD needs to be bought

As always, all speculation comes with a risk. And risk has a cost.

All else equal, HBD at below $1 offers an opportunity of a “free” arbitrage to anyone buying HBD and converting it to HIVE. After all, they get $1 worth of HIVE back for a cost below $1. However, there’s both a risk and a cost involved in this.

First, speculators will have to buy those HBDs somewhere, and then sell the HIVE. This in itself will likely eat away part of the potential profit due to exchange fees.

Secondly, there’s a risk that the value of HIVE could continue to fall. In that instance, since the value calculated by the blockchain of the past 3.5 days will base the conversion on the assumption of a higher HIVE price, the speculator may receive less than $1 worth of HIVE in the end if the market value of HIVE upon the conversion’s completion is less than the 3.5-day average. In the case of the recent market crash, the price of HIVE was highly uncertain for the next 3.5 days, as it could just as well continue falling. If so, the supposedly free arbitrage would provide a loss as the 3.5-day average price of HIVE would then remain significantly higher than its market value at the time.

As a result, we should expect the HBD to briefly fall when there is a wide market crash. And we should also expect its price recovery to take some time as uncertainty is reduced as the market settles. The greater the difference between the current 3.5 day average of HIVE and the market value, the greater the risk. But as the market appears to settle, and the 3.5 day average price of HIVE is close to the current market price, the arbitrage will have less risk/cost and thus become profitable.

And that's exactly what we saw happen, as despite the price of HBD going down rather fast from $1 to $0.9 over a 7 day period, its value against Bitcoin was steadily increasing:

Conclusion

So the take-away is this: Because there are exchange fees to be paid for speculators to pick up HBD and convert, and because there is a risk to be "paid" for doing so, we should expect the HBD to stay slightly below $1 on a normal day. Also, when the price of Bitcoin is falling quickly, it will take time for the market to react and buy HBD, thus meaning that in the very short term, HBD will follow Bitcoin down. If there is also great uncertainty about the price of HIVE, and its value is also seen as likely to go down short term, then the recovery of HBD may take as long as the market takes to settle, as only then is the proposed arbitrage seen as more likely to give profit than a loss.

What does that mean for us? There are always tonnes of ways one can speculate during volatile times. But to me, the best advice most of the time when having HBD when its value is significantly lower than the peg (read below $0.95) is to simply wait. Myself, I will continue to move parts of my HBD to my savings account according to the strategy that I made for the year and not look at it unless HIVE starts falling below $0.5 (both to take advantage of buying HIVE cheap, and also to avoid risking holding HBD should HIVE then continue even further below the "haircut" price level).

After all, having a bit of HBD these days seems like a good idea regardless of what happens next.