Tornado Cash was a De-Fi platform that enabled crypto users to have privacy for their transactions. Though privacy is a human right in nature, the way some hacker groups, Lazarus in this example, pushed policymakers to make sanctions over the platform.

As a result of sanctions, the previous users are blacklisted and many "Decentralized" (?) Finance platforms blocked the wallet addresses from reaching their services. Eventually, first time in crypto history, we saw a sanction on a smart contract and direct imposition to a crypto service.

Crypto Crime Before 2022

I strongly advise you to read the report by Chainalysis.

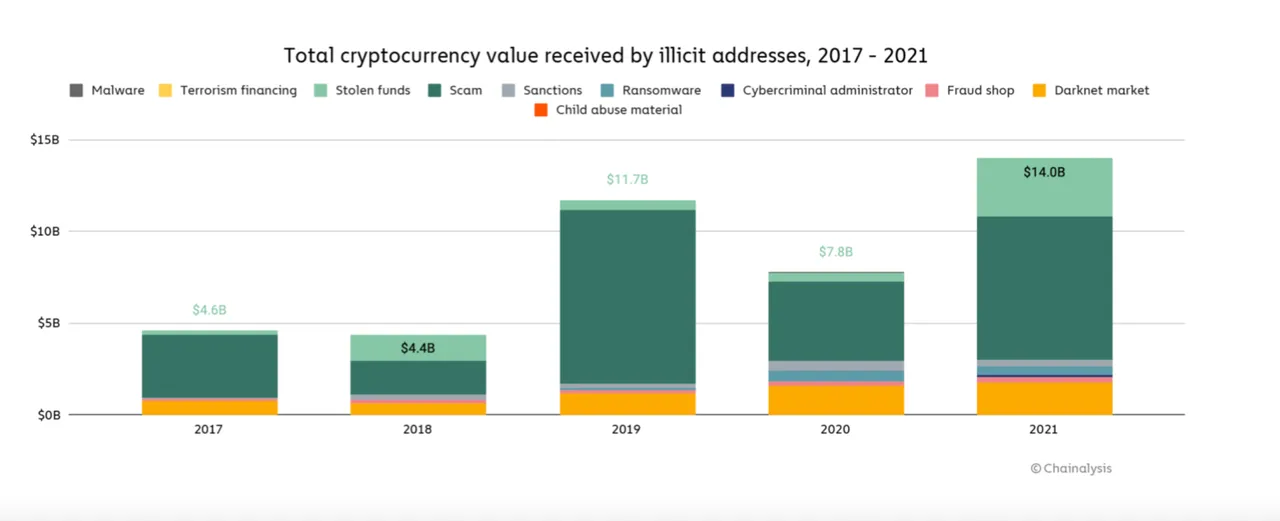

Scams and stolen funds are popular malicious attacks to the crypto investors. If we remember the times of 2017-2019, we had fake ICO's and pump & dump coin launches when the ecosystem was away from mass adoption!

Although these actions were frequent, it was possible to track them thanks to blockchain unless the coins are converted to Moner (leading privacy coin!).

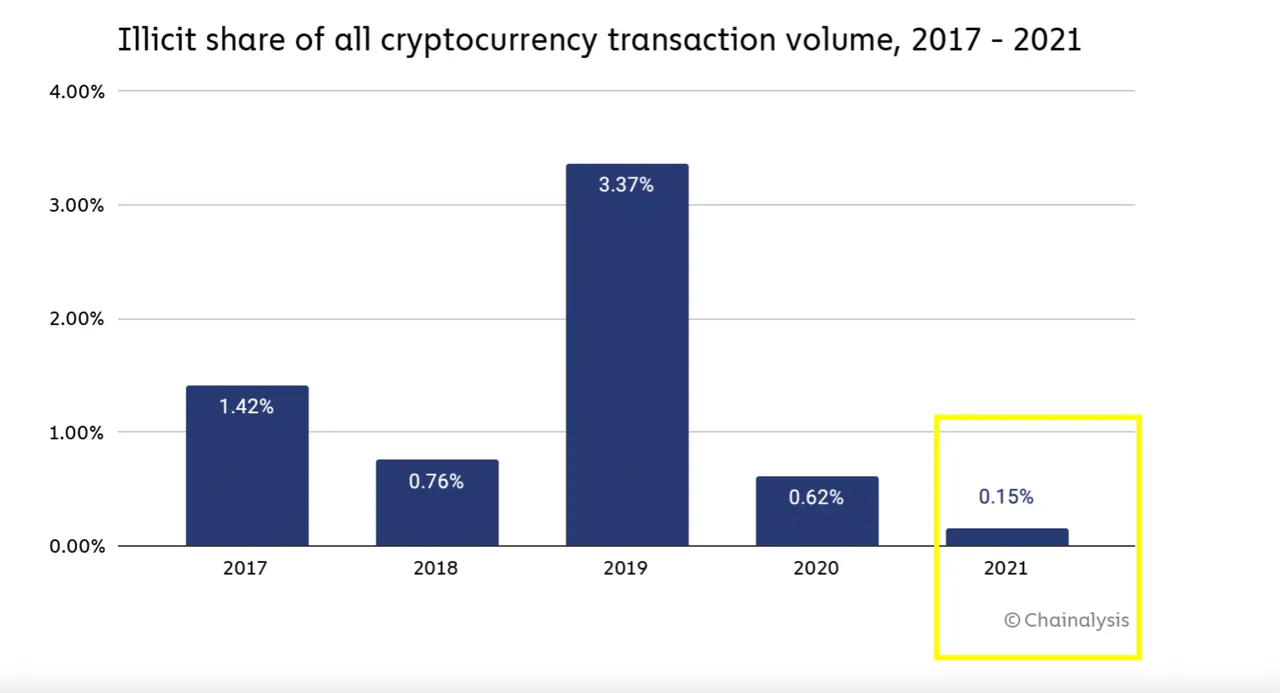

The percentage of these bad actions is relatively less compared to the past.

Some factors may be:

- Growing transaction volume of crypto

- More awareness on the scams & siber attacks

- Adoption of cold wallets

We can say that it happens pretty rarely in a normal market. In bear, the bad news spreads much faster 😅

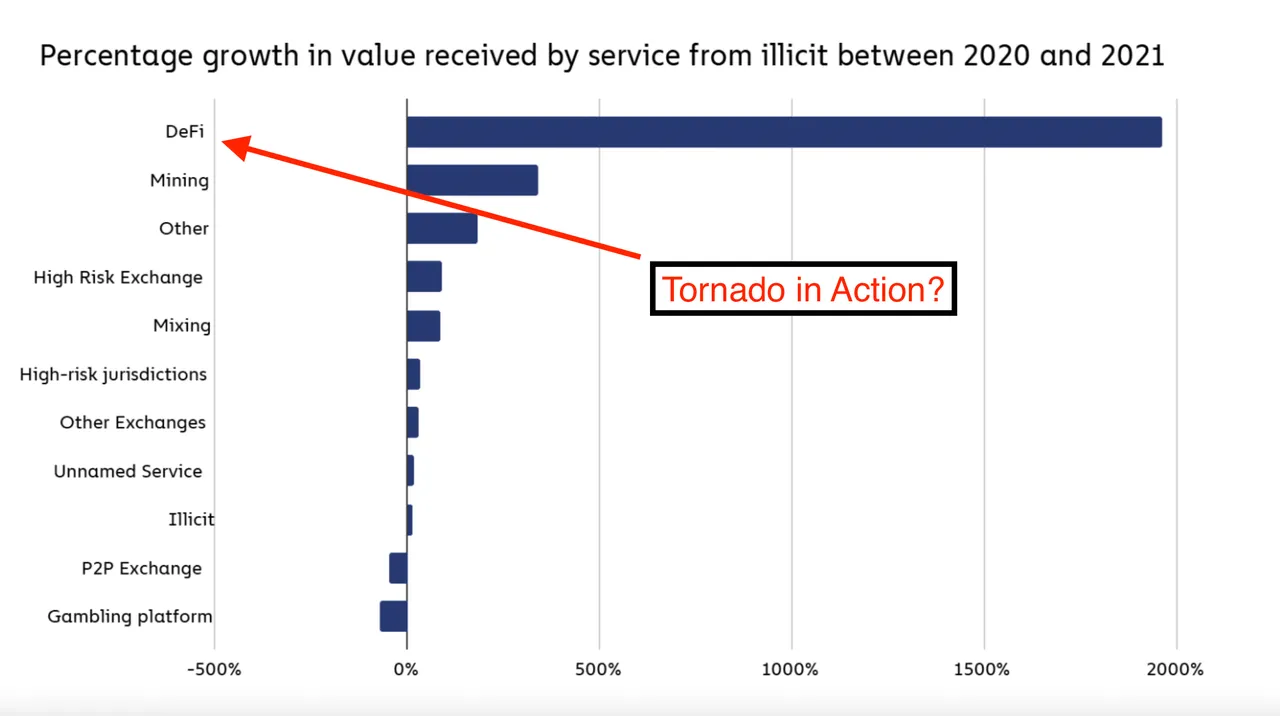

Mimblewimble, zero-knowledge systems and privacy based tokens are solid products. However, De-Fi based privacy projects can easily overthrow them for some reasons.

- Ethereum Network is the source of liquidity.

- Transforming ETH into another coin requires "secure" bridge.

- NFTs, LP tokens and more creates extra burden (more txs) for cross-chain.

- Less-transaction + More privacy.

In the end, Tornado Cash was a perfect service for the hackers to transfer the stolen assets at max level privacy.

DeFi protocols saw the most growth by far in usage for money laundering at 1,964%. -Chainalysis

Money laundering in De-Fi is the most problematic case for crypto in the eyes of policy makers. Like happened via Lazarus for North Korea, there are some other parties that use De-Fi for money laundering or financing terrorism in the world.

In its sanctioning of Tornado Cash, the U.S. Treasury cited its use by the North Korean hacker group Lazarus Group and the laundering of over $103.8 million from the hacks of the Horizon Harmony Bridge and Nomad Token Bridge earlier this summer. - Decrypt

While policy makers try to deal with increasing popularity of De-Fi money laundering, they also sacrifice the privacy right of people at once. In Web2 world, front-end restriction or blocks may work somehow. Yet, Web3 is censorship resistant.

Chainalysis provides an amazing report that everyone should read to have a better understanding of the case of Tornado Cash and De-Fi Money Laundring mechanisms.