Bitcoin is the king in the crypto market currently as at 28/2022. It is necessary to carryout out some specific analysis to study if the price of the token is in any way related to other tokens.

In the course of this article, I will analyze the type of relationship present in bitcoin and Uni token.

Objectives Of The Study

In the course of this article, the following are my objectives;

A brief about correlation analysis.

Categories of correlation test.

Importance of the analysis.

Data collection from coingecko.com of the price of Bitcoin and that of Uni token

Analysis and interpretation of data.

Conclusion

A brief about correlation analysis

Correlation analysis is a test to measure the relationship that exist between bitcoin and Uni token.

In elaboration, we want to analyze if the rate at which bitcoin climbs affects or influence the price of Uni token in any form.

.

Categories of correlation test.

The following are the categories of correlation test.

Positive correlation

Positive correlation between the price of bitcoin and that of uni token indicates that as the price of bitcoin is in a bull state, the price Uni token will be bullish and vice versa.

Whether or not it appears bullish, we shall analyze where the category falls.

This type of relationship tends towards +1 direction on the number scale.

Negative correlation

Negative correlation between the price of bitcoin and that of uni token indicates that as the price of bitcoin is in a bull state, the price Uni token will be bearish state and vice versa.

This type of relationship tends towards -1 direction on the number scale.

Zero correlation

Zero correlation indicates that there is no relationship between the price of bitcoin and that of Uni in the crypto market.

Correlation coefficient is represented by a letter “r”.

For a positive relationship r = 1 or tends towards a positive 1 axis.

For a negative relationship r = -1 or tends towards a negative 1 axis.

For zero relationship r = 0 or tends towards the zero axis.

Significance of the analysis

This test proves is there is a relationship between price of bitcoin and that of Uni.

To examine the direction of correlation and also the intensity or strength. If it heads towards zero point, -1 or +1.

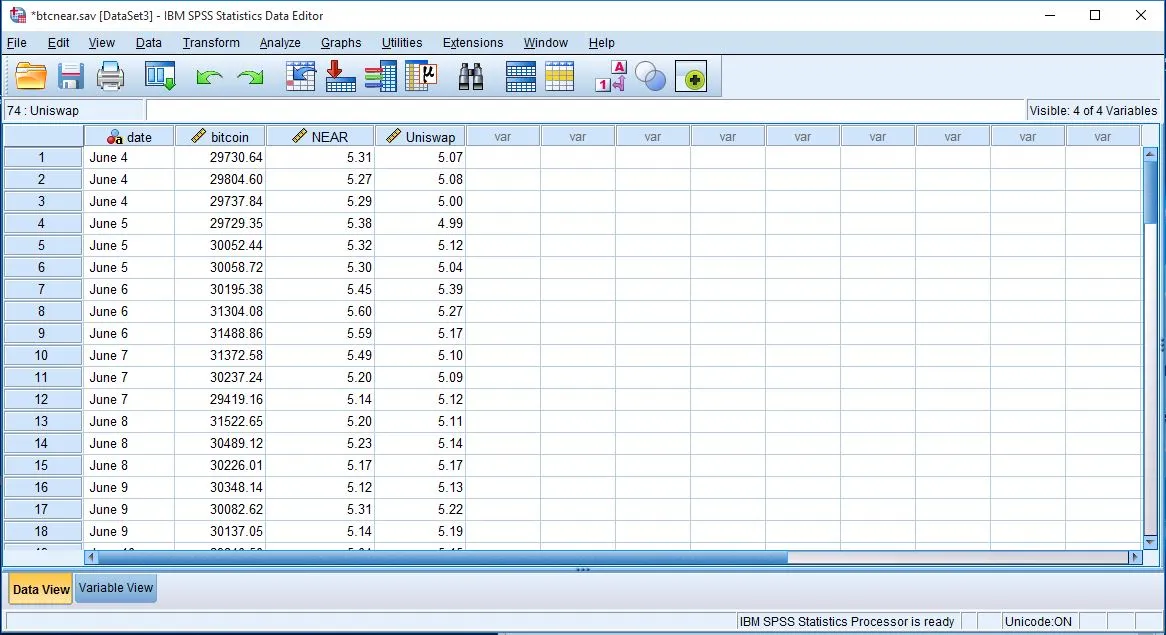

I shall attempt to collect data from coingecko.com. the price of bitcoin and Uni token is presented for the period of June 4 – June 27, 2022.

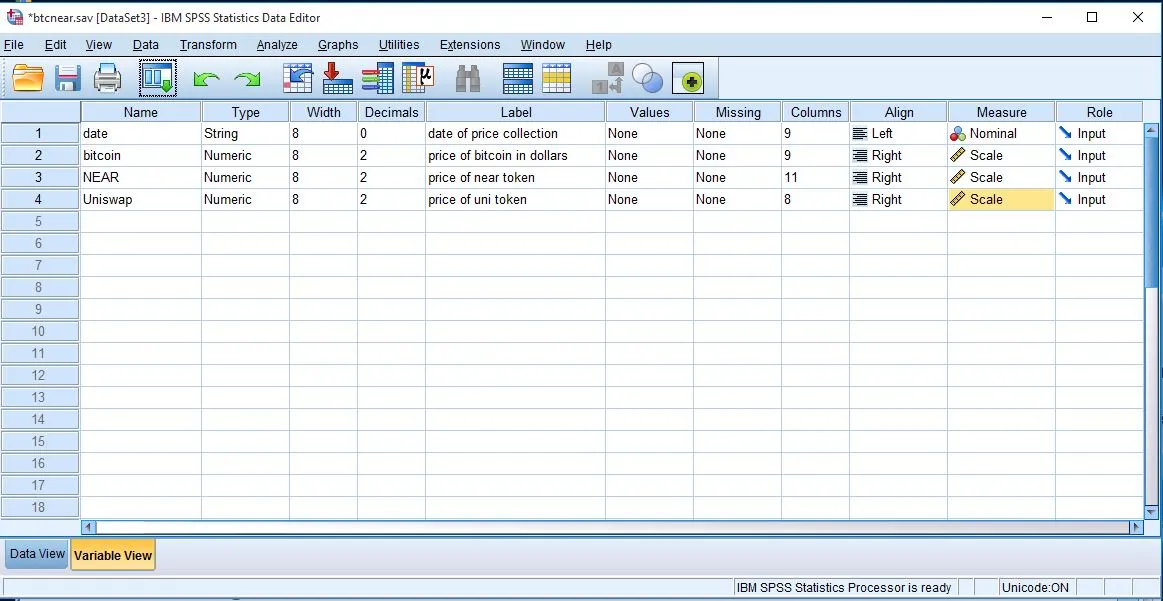

The price of bitcoin and Uni are the second and the fourth variable in the variable view mode of SPSS software.

The data view mode of both tokens can be seen below.

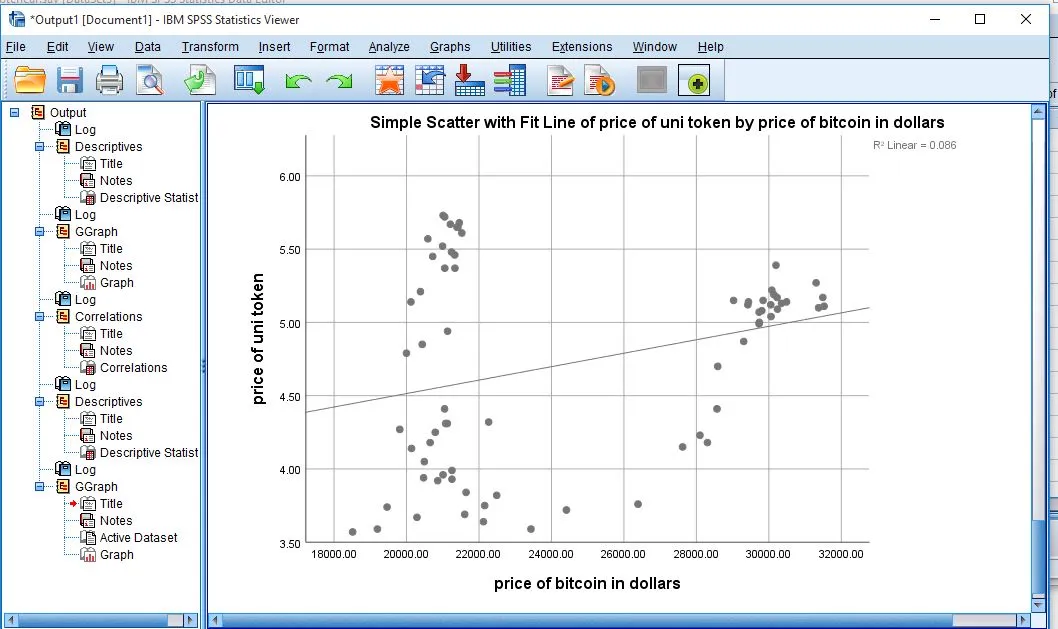

From the analysis of both prices, we shall attempt to consider running a scatter dot diagram.

From the scatter dot diagram, there is a low positive type of relationship but its important to view the strength of relationship.

Result

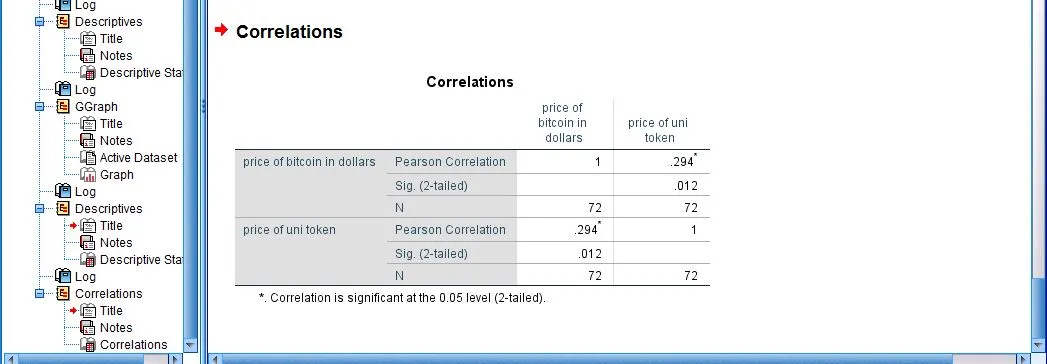

The result of this analysis indicates the coefficient of relationship r = 0.29. This shows a minimum positive relationship between the price of both tokens. The significance of this relationship tends towards zero.

Considering the significance level of 0.05, the significance of 0.012 was analyzed which is way too lower than 0.05. There seem to be a positive relationship which is weak.

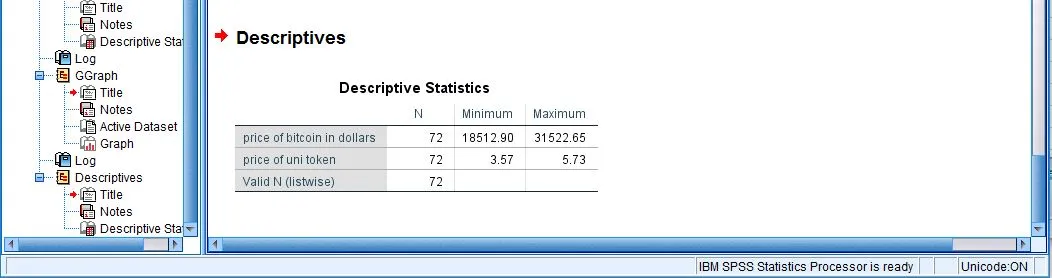

Here is a minimum price and maximum Price of both tokens

Conclusion

From the result of analysis between the price of bitcoin and Uni token, there seem to be a very weak level of positive relationship meaning as bitcoin’s price is in a bullish state, it may or may not influence Uni token. It’s a probability because the relationship is very weak.