With Bitcoin hitting and ALT High today and Splinterlands carrying on with the CRAZY CRAZY I thought it might be a good time to review my crypto holdings, it's been a little while since I've done this anyways...

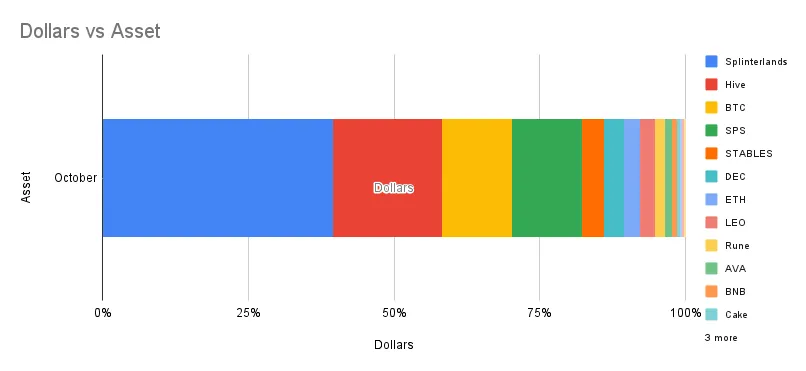

Besides the increase in SPS value, my Crypto Holdings have remained amazingly stable over the last couple of months, and now look like this:

(Yes, soz, discretion leads me to just put the proportions in place!)

My Splinterlands cards are worth around 40% of my Portfolio, and if I combine SPS and the rather smaller value of DEC it goes up to 50% - and that's not even including the TRACT value!

Damn, that's dominant, but, hey, that's cool by me, there's not a lot else out there that yields so well and in so many ways as Splinterlands ATM.

I actually find it easier to analyse everything else by excluding the Splinterlands cards....

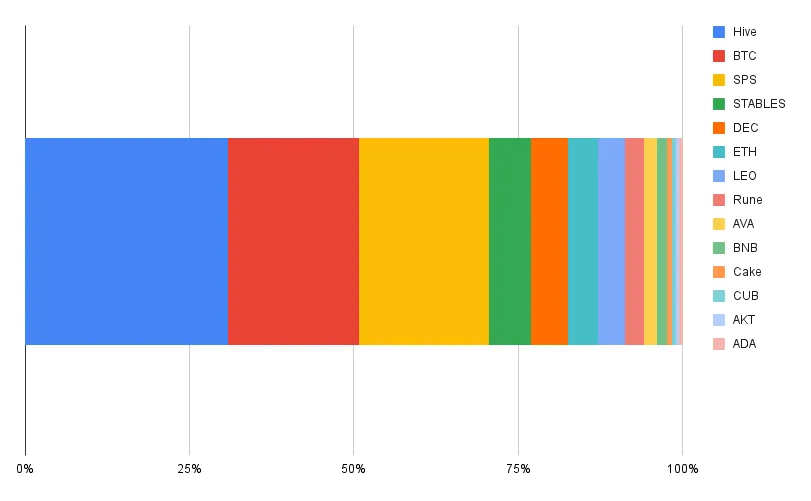

So, after the cards we have...

- Just < 30% = Hive - I've actually PDd a bit, but I've ended up with most of that on Hive-Engine, to pool with DEC, for that juicy 200% SPS airdrop!

- 20% = BTC - I haven't bought anymore recently, it's just sitting there in cold storage mostly, with a small amount compounding on Cub Defi.

- 15% = SPS - This is the biggest growth area recently - I have 52K staked and 3K liquid, I imagine the value of my SPS holdings will shrink a bit over the next month, despite the fact that I intend to stake more and not sell very much. I'm not sure how I feel about having such a whack in SPS.

- 8% - Stables - Nice and balanced, around 10% - split across BSC/ Terra/ Polygon. I should add in ETH TBH!

- 5% - DEC - well it does yield at 200%!

- 3% - ETH - I don't like ETH - I sold a fair chunk for Crypto Raiders, in fact I SHOULD have counted them here, my over all assets defo bring them into the T10 (maybe I'll do this next month).

- 3% - LEO - I have sold a little LEO recently, better returns elsewhere, it's that simple.

- 3% - Rune - Kept the faith with this, hopefully it's going to come good anytime soon.

- 2% - AVA - I recently unstaked all of this - I don't travel much, and now there's no capacity to earn on it I'm probably going to sell a good chunk of it.

- 2% - BNB - I'm a reluctant BNB holder, but it yields so well on so many pooling options.

By the time I get out of the above I've got MUCH smaller amounts of the following, but still quite hefty sums....

- 1% - Cake - I like the 70% return on Cub, in fact I just bought some more yesterday - it looked tempting at $20 with a possible alt pump around the corner.

- 1% - Cub - I did sell some for SPS a while back, but I earn so much of it I've earned it all back again!

- 1% - AKT - There's a lot of attractive staking options on Cosmos - 40% raw AKT, and 100% pooled with ATOM.

- 1% - ADA - I've been accumulating this steadily, and staking it with the Yoroi wallet, with DEFI projects around the corner, I'm anticipating maybe a few airdrops on ADA stakes in the future.

This reflects Hive doing well rather than a lack of balance I think...

As I mentioned above, I have Powered Down some Hive, and sold some LEO recently, so I have been rebalancing out of Hive - the shrinking percentages of everything after DEC reflect Hive and Splinterlands having done so well in the past month rather than my selling anything else - most of my other assets have remained a bit flat....

Hopefully it's their time to 'do something' in the coming month!

P.S. approximate %s above!