Compound interest is built into the Hive Rewards System.

Albert Einstein, the famous physicist and mathematician is often quoted as saying that Compound Interest is the 8th Winder of the World. A metaphor for something truly amazing in its beauty, size or significance.

Reinvesting your Hive rewards acts like compounding and increases your subsequent rewards.

The other day, while studying finance I had a realization that the reward system on Hive, had compound interest built into the rewards system progression.

The amount of your vote, and thus the amount of your 50% share increases if you reinvest your earnings.

And the fact you receive rewards daily, if you post or comment daily, means you can add rewards to your HivePower basis daily. Which mathematically is the most optimizing compounding time period.

:-)

Let’s get into this further below, and I think you will agree that the math underlying the Hive Reward system looks like compound interest.

The eighth wonder of the world: compound interest

Compound interest:

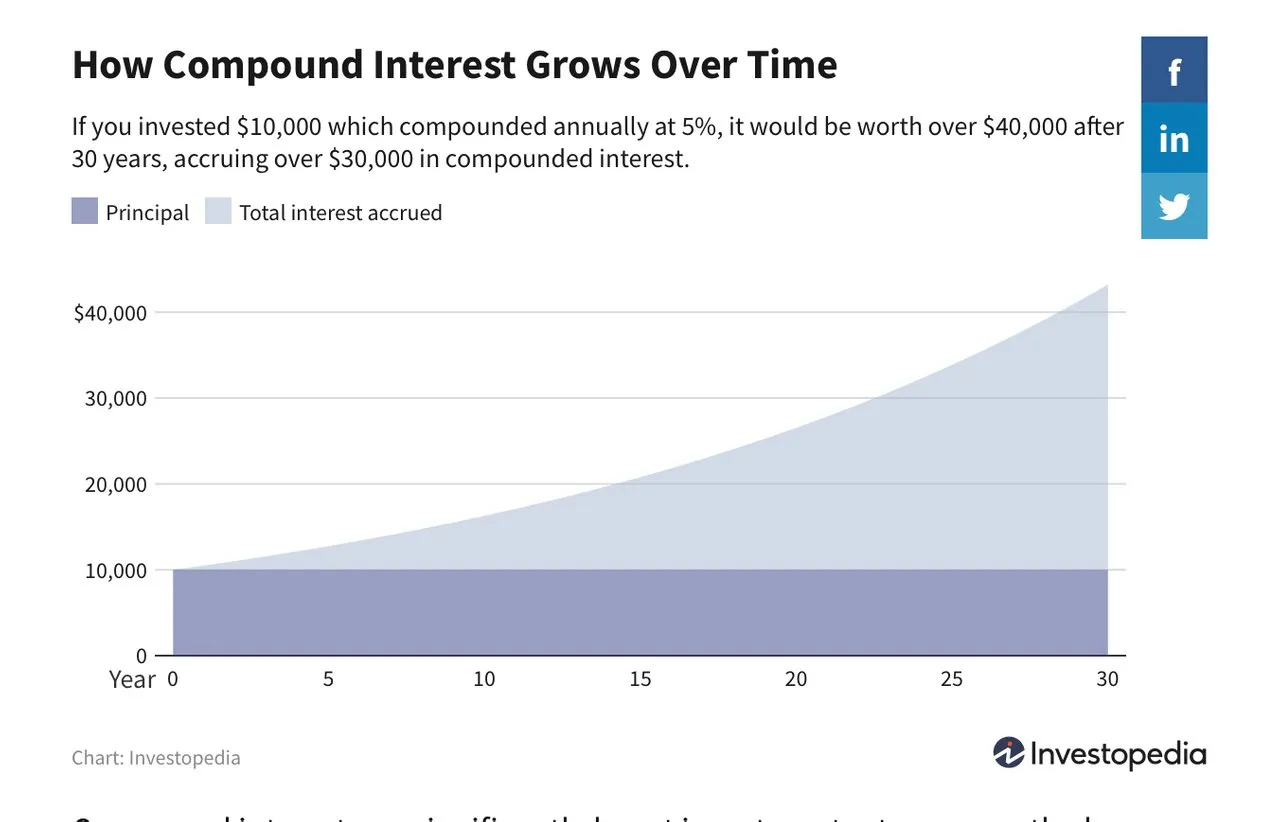

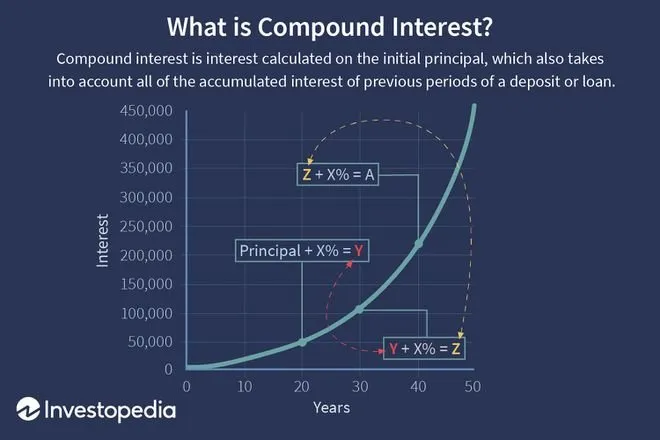

Compound interest (or compounding interest) is the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods.Source; Investopedia

In a similar fashion, the amount of your staked Hive or HivePower determines the value of your upvote, of which 50% is your personal earnings. If you stake or Power Up these rewards, and you therefore increase the size of your upvote and subsequently your personal earnings also. You see this system here on Hive allows rewards to compound, and this same system on defi projects allows rewards to compound. Your rewards grow like the figures on the chart below:

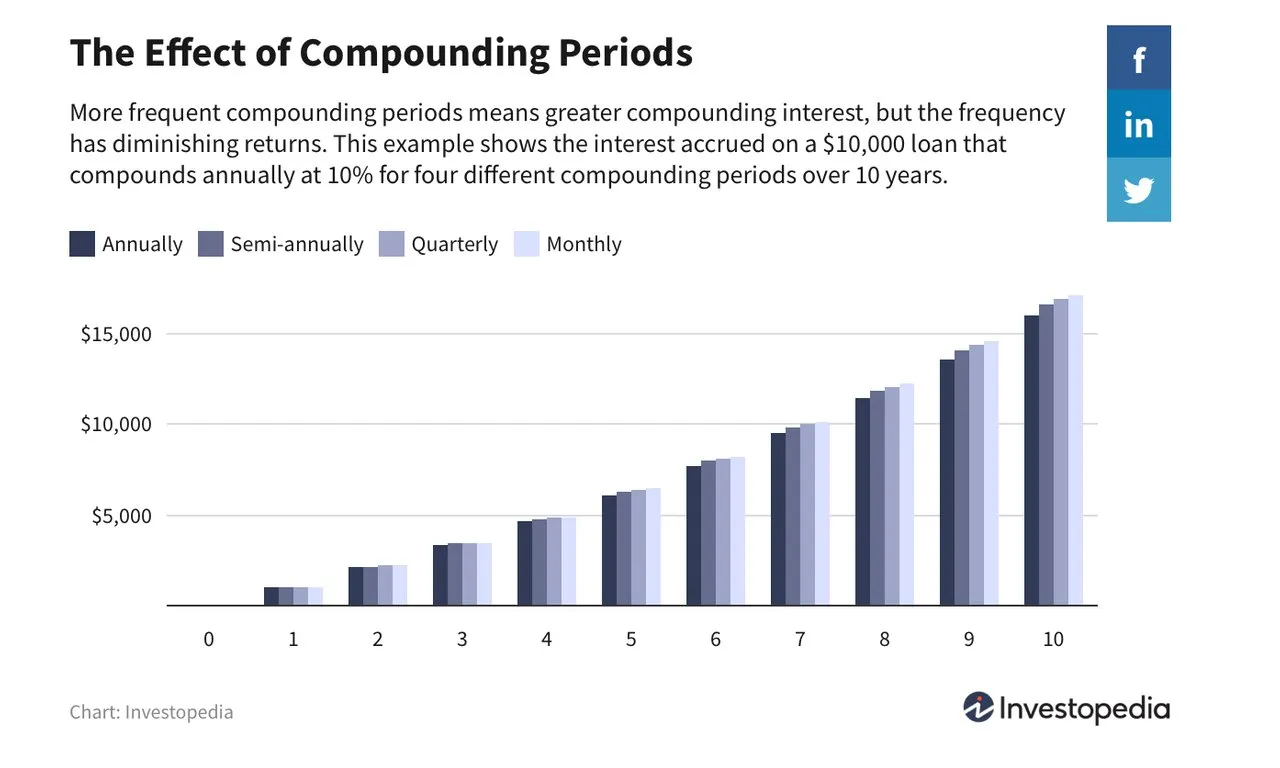

Compounding Periods:

The compounding period is also very important. Reading from Investopedia: When calculating compound interest, the number of compounding periods makes a significant difference. The basic rule is that the higher the number of compounding periods, the greater the amount of compound interest. Source

The following table demonstrates the difference that the number of compounding periods can make for a $10,000 loan with an annual 10% interest rate over a 10-year period.

This is second marvelous mathematical concept underlying the rewards earnings model that underlies the reward system on Hive, Leofinance and also the staking and liquidity providing projects on Cubfinance and Polycub. All of these feature a compounding interest model of earnings, and in addition they allow daily compounding of interest earnings. This is the most optimal compounding period, so it maximizes earnings.

Last words

- I hope you agree that compound interest math underlies the reward system of Hive, Leofinance, and Leofinance’s DeFi projects.

- I hope you share my excitement for both the compound interest and the daily compounding period.

- I appreciate the forethought put into the reward system, which rewards those who power up or stake all or a portion of their rewards with steadily increasing rewards.

@shortsegments

Picture Credits

Charts from www.investopedia.com

Other pictures from www.pixabay.com