We are being bombarded with articles regarding the Hive Backed Dollar (HBD). This is something that is getting a lot of attention on Hive. Certainly, this can be viewed as a microcosm of where the entire industry stands at the moment. Algorithmic driven stablecoins seems to be the "in" thing right now. For this reason, the focus seems to be heating up.

Even the Ambassador decided to get into the game by announcing his own stablecoin on Tron. Perhaps someone should have notified him that he already had one with SBD. Either way, he claims to be paying 30%.

Of course, developing a properly functioning stablecoin required more than just tossing it out there and claiming it is pegged. It even goes much further than simply backing it with a basket of other coins. Instead, there is the development of the coin and the direction it is taking. In an upcoming article we will detail the different areas that are vital.

For now, we are going to take a look at some of the basics as it applied to the Hive Backed Dollar.

HBD Stabilizer

This could be the point in time where we see the shift regarding the Hive Backed Dollar. Before the introduction of the HBD Stabilizer, HBD was completely overlooked. This application started the journey of more eyes turning towards it by approaching the biggest problem: the inability to hold the peg.

Since its introduction, the range of movement on HBD has stabilized. Volatility is the enemy here. For a stablecoin to fill its potential, a very tight trading range needs to be achieved.

As the name denotes, that is the goal of the HBD Stabilizer.

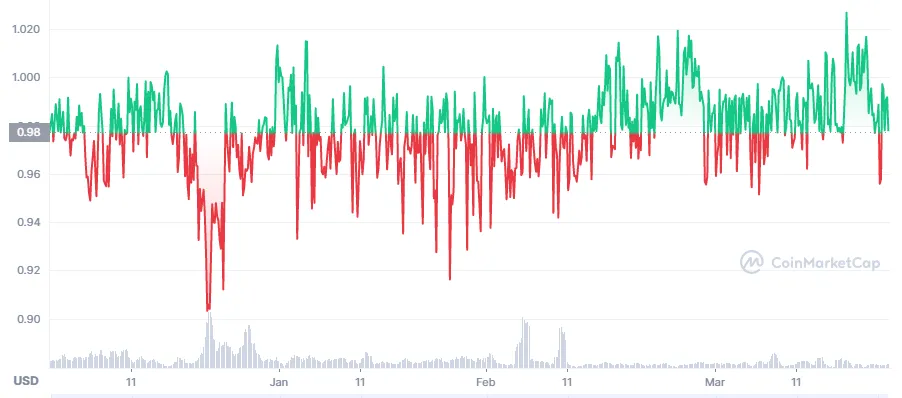

So how did it do? Pulling up a chart, we see the range over the past few months.

This is a fairly tight range. While it is not ideal, it is getting better. As we can see, the downside moves are declining both in terms of magnitude of the drop along with the frequency. Over the past month, things were much tighter than before.

We now see about 5% to the downside and 2% to the upside. This compared to 7% drops in February.

The one year chart shows a marked improvement.

Obviously, the first thing that jumps out about this is the major run ups last year. However, if we look passed that, at the consistent red over the last 8 months, we see it slightly upward tilting. This means the lows are being pulled up, similar to what we see on the YTD chart.

Hence, we can conclude the range of trading on the price of HBD is tightening. That is a positive move. In fact, if HBD is going to be legitimate, this is exactly what needs to happen.

Polycub Liquidity Pool

A lot was made of the pHBD-USDC liquidity pool that went live last week. This was brought out with high aspirations. The goal is to get $5 million of liquidity in the pool.

How is that progressing? So far, after a week, we see the total crossing $300K.

This is obviously well short of $5 million but we have to be fair here; it is only a week. So far, the amount in the pool rose steadily. What this tells us is that it is only a matter of time. In other words, this pool will be viable by the end of the year.

pHBD is obviously a wrapped version of HBD. This resides on the Polygon chain. Each pHBD that is produced is backed by one HBD. The HBD resides in the @p-hbd account on Hive.

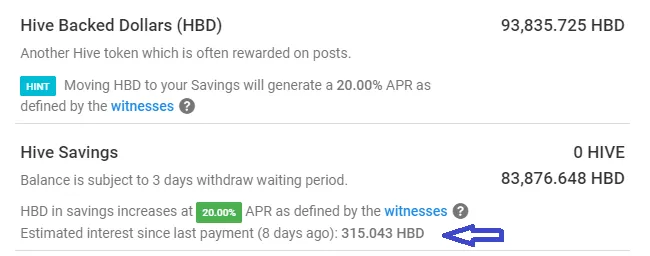

With the HBD that is submitted to be in the liquidity pool, 50% is being placed in Hive Savings. This is earning 20% APR, generating more HBD.

Here is what the account looks like:

Source

As highlight, we can see that by depositing the HBD into the savings, there was 315 HBD generated in a little over a week. This is a number that will obviously keep growing.

The key point with a liquidity pool is to provide people with access to the token This is the equivalent to an exchange in the decentralized world. Here is where people can go to swap USDC (or any Polygon based token) for pHBD. Then, if the person want to get on chain (Hive), the bridge can be used to convert the pHBD-to-HBD.

There is another benefit to this and it ties back to the HBD Stabilizer. Suddenly, when the LP is deep enough the Stabilizer has help. One of the keys for anything to hold a peg is arbitrage. Therefore, having liquidity so traders can easy enter and exit trades when there are market distortions is crucial. Traders who arbitrage are looking for the gaps, in pricing, in different areas. Hence, if the LP gets way out of line to the downside, as an example, one could buy pHBD and sell HBD. A percent or two can make a huge different when playing with enough money.

Here is where we see two things that are crucial. The first is obviously to have enough liquidity so major players can enter the market. Second, we want to have as many different pools as we can so there are more arbitrage opportunities. This is what entices traders.

Fortunately, the Polycub pool is going to be replicated on a number of blockchains as that ecosystem expands. It is likely that we see a liquidity pool of bHBD-BUSD appearing on BSC in the near future. This will provide another entry point for people seeking to get involved with HBD.

Total HBD

The important thing is to keep watching the total HBD that is available. This can be found at Hiveblocks.

One important note is that roughly 14 million of that total is housed in the Decentralized Hive Fund. This portion of the float is effectively off the market since it cannot be released in large quantities. Thus we can conclude the total amount of HBD available is around 10 million.

That is where things stand at the moment. While many are looking at explosions in the stablecoin market, it is important to get a solid foundation in place. Here is where projects can blow themselves up. Inevitably, many will find themselves on unsure footing if they get popular.

Here we covered some of the basics. As mentioned, an upcoming article will detail some of the other areas of development that are crucial for stablecoin success. Here is where HBD has a solid opportunity because many of those are already starting to be worked upon.

Hopefully this helps to clarify some of the questions regarding HBD and how it is doing.

What are your thoughts? Let us know in the comment section below.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z