Image by Sergei Tokmakov Terms.Law from Pixabay

Red Dip on 24th Feb in the crypto market was a time of uncertainty on the macroeconomic climate

On 24th February, the crypto market was quite red, which gave me a mildly uneasy feeling. Since I am a crypto Hodler, I am not known to panic sell, yet whenever a big dip takes place I really want to understand why it’s occured. Is it because of the crypto fundamentals or other macro economic reasons?

Later it was all over crypto news that the crypto market fell in reaction to Russia’s attack on Ukraine. Lot’s of things have changed since then, but that made me realise at that time that we can’t assume that the crypto market cannot fall further.

From Tradingview

There were Red days in the crypto market from Feb 8 - 24th with the fall in Crypto Market Capitalisation from 2.25 trillion $ to 1.5 trillion $. Things changed on Feb 28th with a uptick on market capitalisation to 1.84 trillion $ with investors beginning to buy crypto assets. Notice the big green candle there!!

Risky market conditions for DEFI players who have deposited their crypto as collateral

This holds a lot of significance for DEFI folks who have put their crypto as collateral, for if the crypto collateral value falls before a certain threshold one’s collateral can get liquidated.

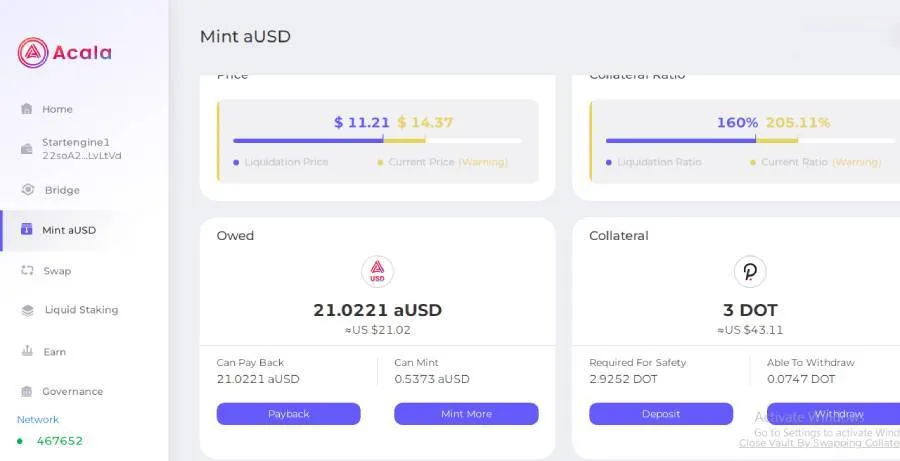

I had put my DOT crypto as collateral to mint aUSD stablecoins in Acala. The red market conditions had me worried about my DOT collateral and I realised why Acala’s Early Adopter program was recommended only for experienced DEFI players to dabble with the Acala Platform in its early launch stages.

Tradingview chart

Fall of DOT price from 18$ to 14$ had me worried about my DOT collateral I deposited in Acala platform to mint aUSD stablecoins.

My DOT collateral cover for minted aUSD was sufficient and held up during the period of price decline

I had minted 21.0222 aUSD coins depositing 3 DOTs as collateral in the aUSD mint vault. The price of DOT at that time was about 18 $.

My DOT was subject to be liquidated when the collateral value falls below 160% of the value of the minted aUSD as is clearly displayed by the data provided by the Acala DEFI platform.

Acala DEFI platform

That’s details about my DOT collateral ratio shown in Acala Platform, with well presented data giving me an idea on how safe my DOT collateral is from liquidation.

Thankfully, even though my DOT collateral value fell with DOT’s price coming to 14$, my DOT collateral value was sufficiently more than the liquidation threshold with the crypto collateral value still being 205% of the aUSD coins minted.

Level of liquidation risk had increased with the decline of my crypto collateral value

So far so good, but with Russia’s war on Ukraine, I was hearing there will be uncertainty in markets and prices of crypto could fall further.

If DOT’s price was to fall below 11.21$, my 3 DOTs I deposited as collateral are subject to liquidation. Acala platform also warned me with the yellow line indicating that there was some risk of liquidation if there was further price fall of my DOT collateral.

When I deposited my DOT collateral to mint these aUSD coins, I had a green line indicating that my collateral deposit is secure with there being significant collateral value backing my minted aUSD coins.

Possibility of liquidation due Price Oracle malfunctions during times of peak activity

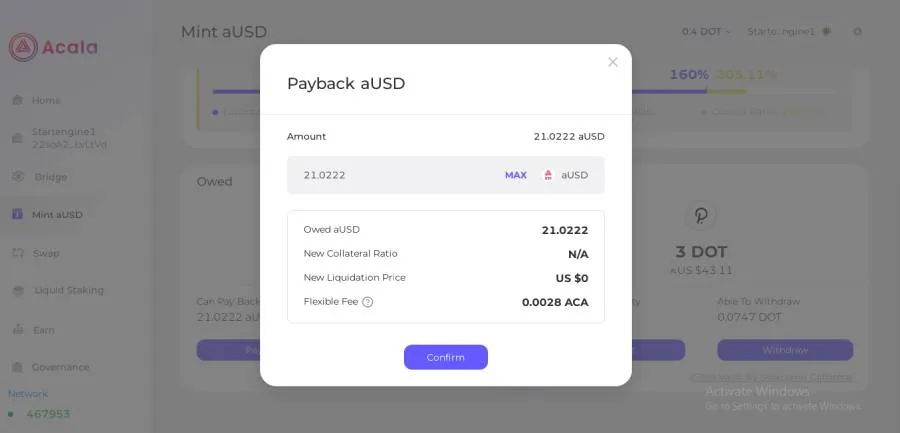

So, I decided to pay back my aUSD and withdraw my 3 DOT collateral.

Russia’s war on Ukraine was one factor, but there were other factors that could cause liquidation of my DOT collateral.

For instance, if Acala’s oracle malfunctioned and showed faulty price of DOT, then also my DOT can get liquidated even if the actual price of DOT has not fallen to that liquidation threshold level.

This is a known Defi risk factor, and liquidation of crypto collateral has happened in the Terra ecosystem with the Anchor protocol, recently in SolLend Protocol of the Solana ecosystem and earlier in the Compound Defi protocol of the Ethereum ecosystem because their oracles malfunctioned showing faulty price.

Wanted to free myself of unstable stablecoins pegged to deposited crypto collateral value

This was why I decided to free myself of aUSD coins that I got by minting through collateral deposit, I was ok with aUSD coins that I can get by swapping DOT or LCDot.

There are actual elements of unstability with a crypto collaterised stablecoin

For me, since I am not such a DEFI user, dealing with crypto collateral created aUSD in times of uncertain market conditions and crypto volatility is stressful.

Such a decentralised crypto collateralized stablecoin, seems unstable to me. Anyway…

I brought some DOT by converting some of my Matic to DOT. Then sent 2.4 DOT from Polkadot Relay Chain to Acala via the bridge. Then swapped that DOT to aUSD and then paid back the 21 aUSD coins that I minted.

Paid back 21 aUSD coins and withdrew my DOT collateral. The fee for this activity was paid through ACA token.

After this I was free to withdraw my DOT collateral. I also got more aUSD by swapping some of my DOT to aUSD.

I did this because in Acala Platform aUSD is the currency through which most things will function, so having some real stable aUSD coins won’t do any harm surely. The aUSD that I got by swapping is actual stablecoin for me, without me needing to worry about collateral liquidation.

DOT crypto’s price only rose further, it experienced no further price declines

Anyway… I noticed the price of DOT never really fell from 14$, it has now risen to 18$ so even if I did retain those DOT collateralized aUSD coins I minted, no DOT collateral deposit of mine would have got liquidated but to each his own, I did not want to risk my DOTs getting liquidated so I got out of my collateral position.

Besides, I learned something in DEFI about how unstable crypto collateralized stablecoins can be which was something new to me.

From tradingview

I would not have had my DOT collateral liquidated if I did not back the aUSD coins I minted, because DOT's price did not fall any further, on the contrary its only risen up!!

Crypto community making news supporting Ukraine with donations - it was heartwarming!!

I am so blessed to be so involved in the crypto space for I read that our crypto community supported Ukraine with crypto donations.

Love the way they non-violently showed their stance against Russia’s invasion that was done not because Russian Citizens wanted it, it’s because of their president Vladimir Putin's mad Hitler like will.

Anyway… more on that, and Bitcoin’s reaction to Russian currency Ruble’s fall in another article.

Boy oh Boy, such interesting crypto events following the Russian-Ukraine attack. Anyway, my best wishes to Ukrainians and our stuck Indian medical students out there, I really wish and pray that war is over and you guys have peace and safety.

Thank you for reading!!