Indian crypto investors will now have crypto taxes suddenly to think about, even if they don’t make the required high earnings to warrant such a high amount of tax.

I have talked about this unique 30% flat crypto tax that Indian Government proposes to make on profits made on transfer of virtual assets here -

The Indian crypto community lobbies the Government to reduce the grand 30% crypto tax

Indian Financial authorities have clubbed crypto investment with the gambling class

Well, it’s evident the Indian Government is looking at crypto in a negative light to charge straight 30% tax without deductions, exemptions etc. Losses in crypto cannot be adjusted with gains made on another investment class, and losses cannot be carried forward to the next year.

Practically, this 30% tax on crypto assets without accounting for expenses of Blockchain transfer fees, gas fees, electricity etc will amount to well much more than 30% tax on any profits made, it is killing earnings crypto people make in any way at a time when the financial situation of most Indians is tight.

This is not a fair tax, and this crypto tax rate is charged considering the crypto industry as a gambling industry, as these kind of tax rules are applicable to earnings made out of lottery, gambling, horse race betting etc.

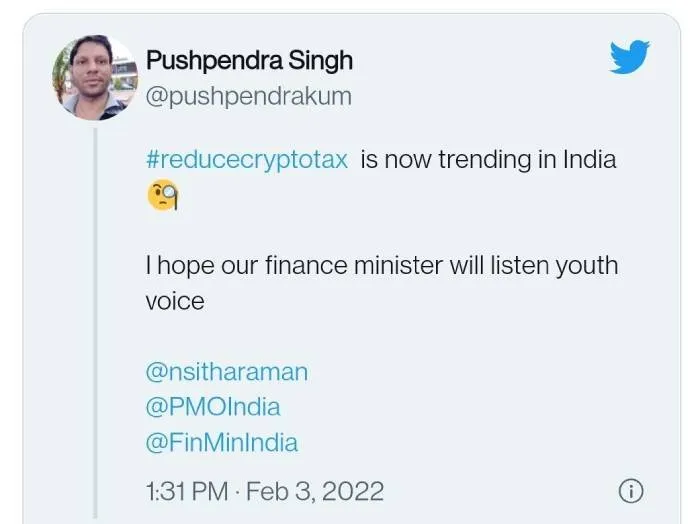

Indian Government have not listened to the Indian Crypto community’s request to #ReduceCryptoTax

Well, anyway, can we do anything about government’s attitude towards the crypto asset class, Indian crypto investors have already petitioned to the Government to Reduce crypto Tax and introduce fair tax and we tweeted India’s PMO, Financial Minister and concerned authorities to introduce #FairCryptoTax and #ReduceCryptoTax.

Over 96,500 people have signed the petition urging the Indian Financial authorities to reduce tax and levy fair tax on crypto as is levied for other asset classes like the share market.

We have expressed that penalizing the crypto industry will curb innovation, India will be left behind other countries of the world involved in building and exploring Blockchain technologies, but the Indian government is not heeding to the voice of the Indian crypto community even though #ReduceCryptoTax and introduce #FairTax tag was trending in twitter.

Twitter trended with #reducecryptotax tag and yet the Indian Govt. has not listened to the voice of the Indian crypto community.

Harsh Crypto Tax rules when an Indian Blockchain company has made it big in the space!!

Polygon is an Indian Blokchain company and Polygon's native token, Matic is the 18th largest crypto in terms of its market cap, according to Coingecko data. Matic's market cap is over 9.8 billion $.

These rules are made in spite of an Indian Blockchain company, Polygon being really big in the crypto space, being the top layer 2 scaling solution for one of the biggest and oldest Blockchain entities in the world, Ethereum.

Co-founder and CEO of Polygon, Sandeep Nailwal, has expressed that this kind of treatment of the crypto space by India’s financial authorities, will result in brain drain as Blockchain developers, entrepreneurs and even crypto investors will flock to more crypto friendly countries where crypto regulations are friendly.

This will obviously result in potential revenue loss for the Indian Government.

Sandeep has said that even Polygon, its team may have to relocate to another country leaving India if crypto regulations are harsh.

Well…anyway…

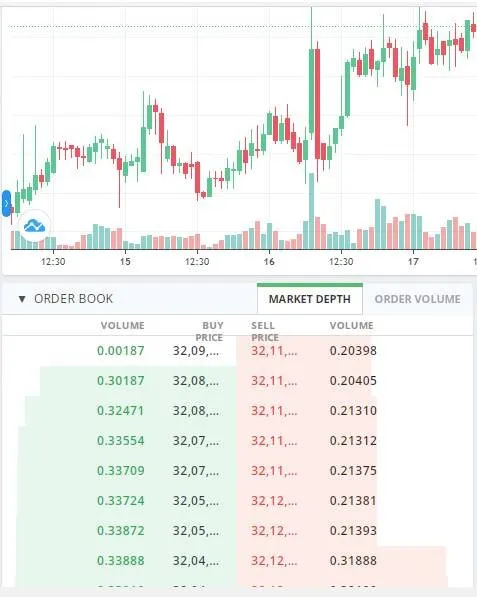

The 1% TDS provision will kill liquidity in Indian crypto exchanges and reduce trading volumes

Now, looking at another aspect of India’s crypto tax that will negatively impact crypto trading in India and this aspect is the introduction of 1% TDS on crypto trades above a certain threshold, which is Rs 50,000.

Tax Deducted at Source is refundable, as it can be claimed by traders when filing their tax returns, however this decreases the amount of capital available for trading. This eventually discourages crypto trading as with each trade, 1% is cut and goes to the Government.

Crypto traders will make less profits, there will be less trade volumes and liquidity in Indian crypto exchanges, which will reflect on crypto prices which will be lower than crypto prices in the international crypto markets which has exchanges like Binance, Kraken that have high trading volumes and liquidity.

Eventually, crypto trading will not be lucrative for the Indian crypto enthusiasts if they use Indian CEXs that implement Government’s arbitrary tax provisions.

Order book screen shot of WazirX Exchange BTC-INR pair. Trading volumes and liquidity in Indian CEXs will reduce if the 1% TDS provision comes into force.

WazirX’s CEO, Nichay Shetty has explained how this 1% TDS provision will result in revenue loss for the Government, who will have a lot of TDS refunds to do as well and get less tax revenues as traders make less profits as they have less capital to trade.

Hmmm… anyway.

Expecting chaos in the Indian Crypto Market soon due to these extremely harsh tax rules

Let’s watch the chaos that will unfold on the Indian crypto market next month, with these totally harsh crypto tax provisions coming into effect on April 1st.

TDS provision will take effect later on July 1st, hopefully the

Indian Government is expanding the time window for this because they are thinking about this provision and maybe they will make some sensible changes…anyway.

You can read my previous article on the topic of Indian Crypto Tax here -

The Indian crypto community lobbies the Government to reduce the grand 30% crypto tax