Hello

Fiat depreciates in value thanks to inflation, so no point in holding it especially for a long term. Fixed deposits are a nice option, but returns are usually lesser than inflation. I just gained access to some of the funds for medium to long term. Since I cant risk them by investing them, so I am planning to put them in stable coins and earn yield on them.

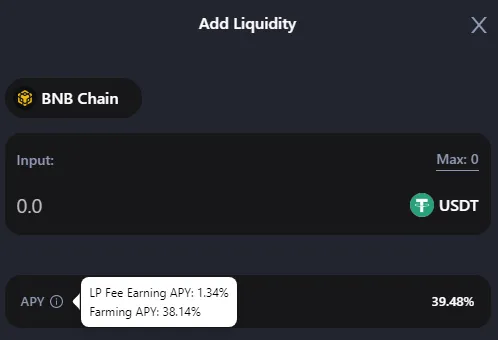

Yesterday in my pursuit of stable coin farming, I stumbled upon Celer Network. They were offering decent APYs on stable coins liquidity deposits. e.g. USDT liquidity deposit in Binance Chain were offering 1.34% APY in Bridge Fees and 38.14% APY in farming rewards. Those juicy APYs did intrigued my interest at first .

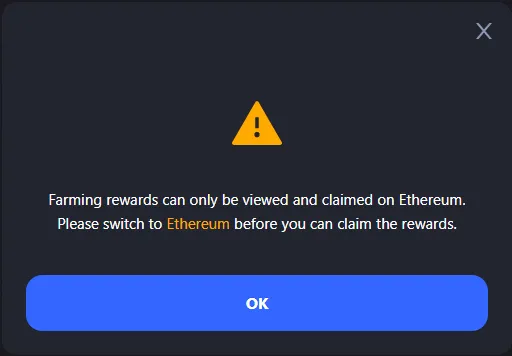

But as I researched more, I found some more details that made Celer Liquidity providing less attractive for me. First of all, the farming rewards are paid on Ethereum network, hence come in play the Ethereum network gas fees. May be if you are whale providing millions of dollar liquidity, you can afford to harvest farming rewards often in order to benefit from that attractive APY, but for small liquidity providers Ethereum gas fees is gonna eat away all the returns.

Second, whereas the bride fees are on auto compounding, the farming rewards are not auto-compounded so they needs to claimed manually and like I said on Ethereum network. Bite me, Ethereum gas fees.

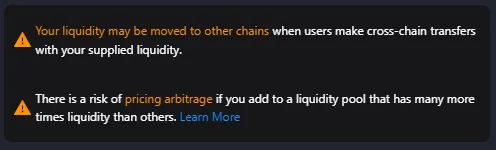

Third there are risks involved, like your provided liquidity may be moved to other networks as users make cross-chain transfers and second the risk of pricing arbitrage. Imagine providing liquidity on BNB chain and having to go to Ethereum network to claim it back, not pleasant indeed. Fourth and final reasons is, those bridges are vulnerable to hacks and exploits as we have witnessed in past multimillion dollar bridge exploits.

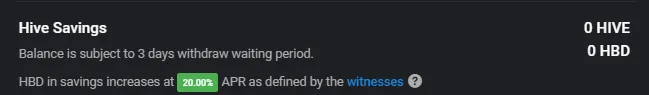

Due to all above reasons I decided to stayed away from providing liquidity at Celer Network. So far I have reached conclusion that Hive network's HBD staking rewards offering of 20% APR is the best. First of all it is as secure as it gets, plus there is no transaction cost so one can claim those APRs monthly and stake them again to enjoy even higher APY.

Celer network liquidity providing may be a good option for those whales who can provide enough liquidity to earn sufficient farming rewards for that Ethereum gas fees not to matter. But for smaller fishes like me, HBD staking is the best option. I plan on moving my funds soon on Hive and start enjoying that juicy HBD APR.

Thought?