Good day Hiveians!

Join me in analyzing the crypto markets!

Wow, so looks like it's time for a new outlook to the markets in general

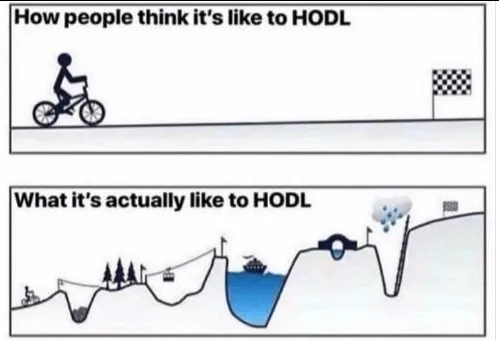

It never gets better over time to see your portfolio getting deeply saturated in red. But these times are always good for reflecting on the larger picture. Like, are the cryptos you have worth hodling? I mean, do you think that they are actually a good investment, fundamentally speaking? Or are you just holding bitcoin because you want to have X amount of returns? If it is the latter, then you will probably sell now at 35k because you probably sustained heavy losses. But if you are hodling just over a year, you would still be in green! Pretty cool...

Anyone who has looked at the price charts sees that the market works in waves. Up and downs, and up and downs on different scales. But it is a different thing to actually know that the market works like that. If you know it, then you won't sell at the troughs and you won't buy at the peaks. The opposite is of course a much better strategy; but I guess my point is you don't even have to try to do that if you think long term. If you accumulate a coin that you believe in (like Hive ;) then you can accumulate gradually without trying to get into the best positions. Over time you will make a profit, the challenge is to hodl...

I want to review my past outlooks here and give one (final) revised one for this bull market

Yes, you heard me right, we are still in a bull market!

I expected a crash down to 20k and then a huge rally to 200-300k. Well, that didn't quite turn out as expected, although it did predict the "Bezos Rally" quite well.

- This outlook changed when the big correction didn't happen. This was then the second outlook:

My reasoning here was that every bull rally was trading in an upward channel which I thought to have identified with these trend lines. But upward price momentum faded. So we are left with one final outlook I want to give here in the hopes that it will work out. Once again I feel confident about this outlook, but obviously I might be mistaken.

- So this is the third and final outlook. What I mean by final is that I expect the bull market to end in the next 3-6 months.

But before I present it, let's just go over why the second outlook failed.

Crucial for this scenario were these two blue trend lines which would have acted as the price channel for which BTC would have traded in. But in January the lower trend line was breached. This invalidates the whole scenario very clearly as we would have needed this support to reach 200-300k.

So what are we left with? My third scenario is based on the idea that Bitcoin cannot go lower than 35k. If it goes lower than 34k, consider this scenario as invalidated as well. And this is why 35k is crucial; there is one last trend line that is acting as support. If it fails, I think we would officially enter a bear market.

This thicker blue trend line which can be drawn all the way back to 2018 is the last support for a bull market. There is obviously a lot of horizontal support as well, but this level has to hold for a recovery. I also drew in two parallel trend lines to the top which should act as the new high for this cycle. As you can see it is a lot lower than the previous outlook. As such I am expecting 100k to be the top.

As pointed out, the thicker blue trend line would be crucial for this scenario to play out. But there is another reason for a potential still higher high. This is that the "2" is higher than the "1". I have never seen bitcoin going for a new high and then entering a bear market. If the "2" would have been lower than the first wave one could argue that we have already entered a bear market. However, it seems to me that we could have a 3 wave top for this cycle marked with the 1, 2, and 3s. This would be somewhat uncharacteristic, but many analysts have pointed out already several years ago that 100k should be the top for this cycle due to the logarithmic curve connecting all previous highs.

As a general reminder: Please keep in mind that none of this is official investment advice! Crypto trading entails a great deal of risk; never spend money that you can't afford to lose!

Check out the Love The Clouds Community if you share the love for clouds!