Surprising Discrepency in Inflation

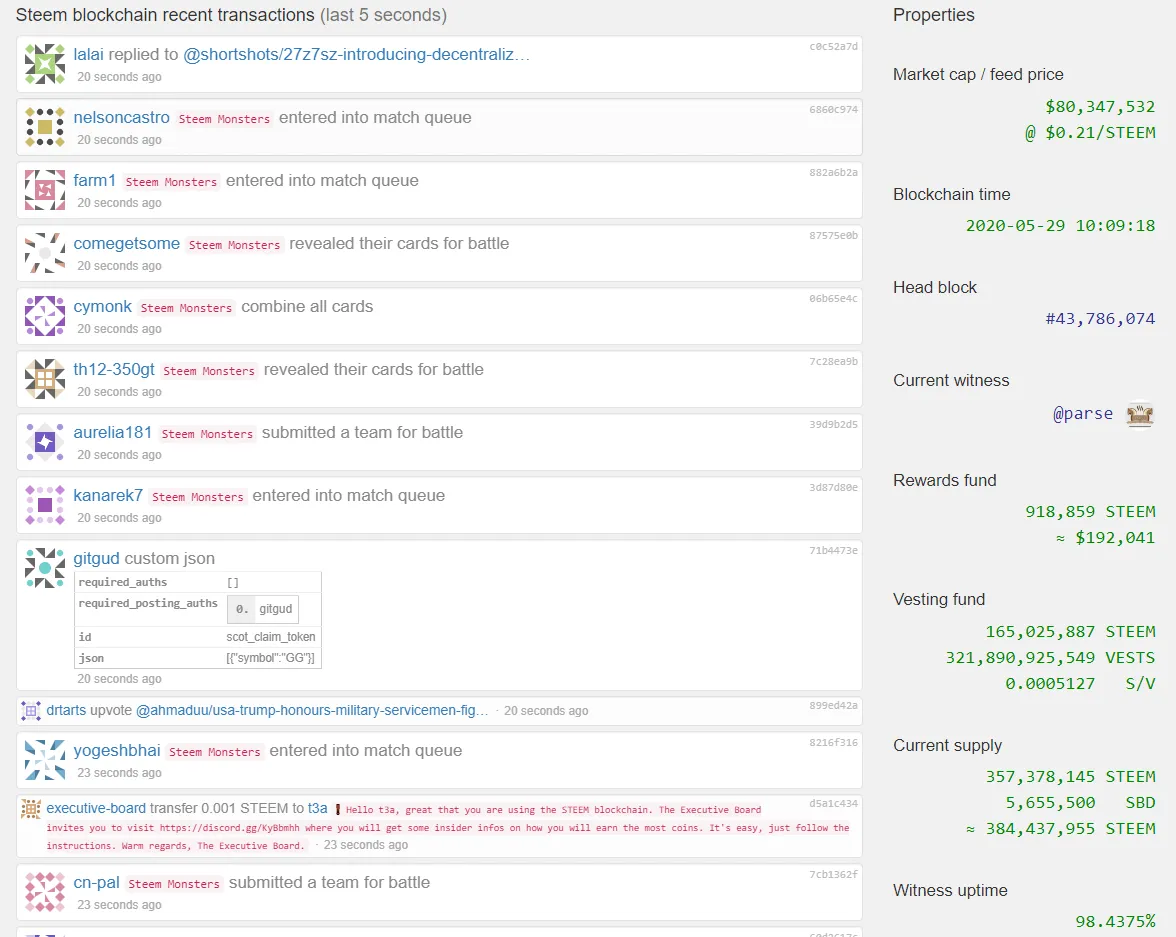

Take a look at https://steemd.com

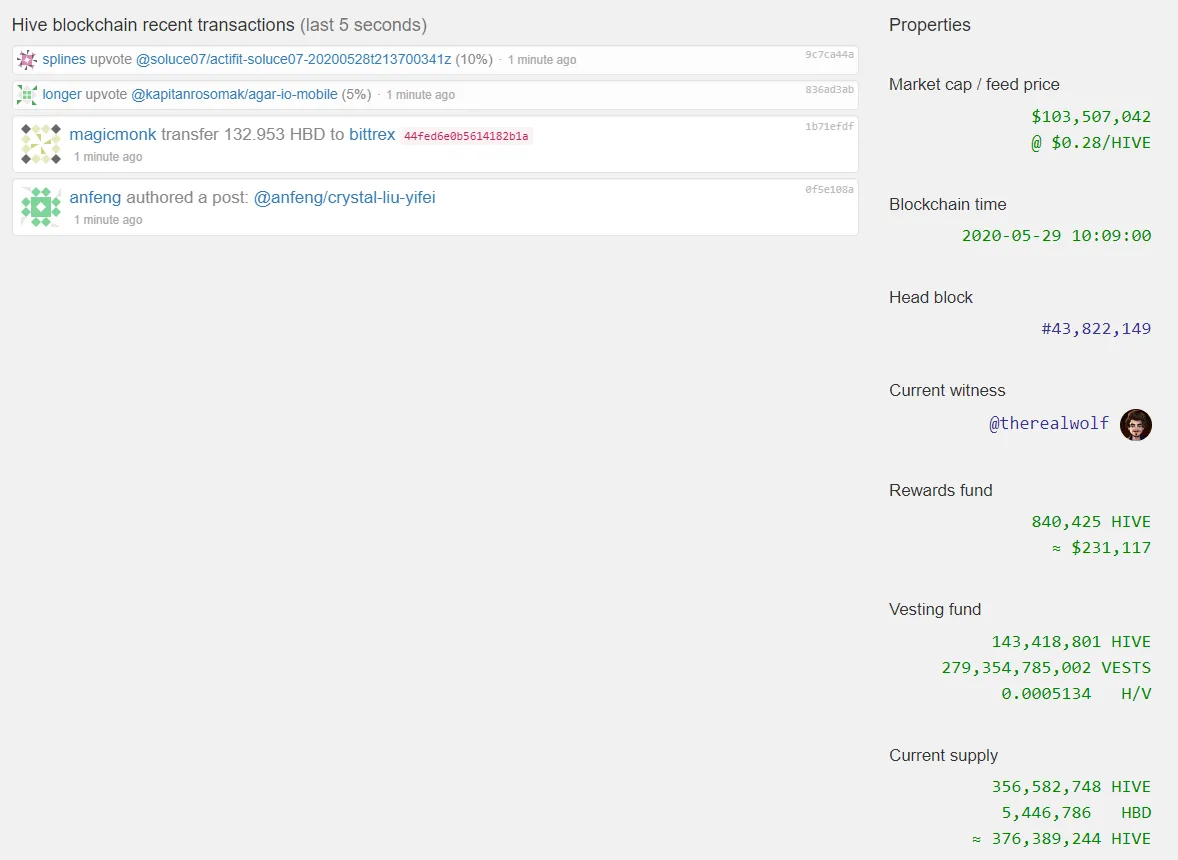

Now take a look at https://hiveblocks.com

Do you notice anything peculiar or unexpected? (The title of this article should give you a clue where to look).

How about this?

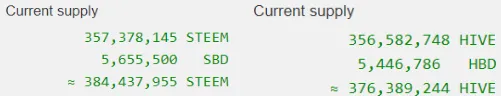

There's almost 800,000 more Steem than there is Hive. There's also more SBD than HBD, and when Virtual Steem and Virtual Hive are considered, which include the virtual collateral behind SBD and HBD, there's a shocking 8 million more Steem than Hive in existence.

There has only been 10 weeks since the fork, and there have not been any prolonged outages that would explain a large difference in supply. In such a short time There has managed to be 800,000 more new Steem and 8,000,000 virtual Steem than compared to the Hive branch. Steem and Hive are supposed to be using the same issuance curve. Therefore, they should have the same inflation, right? Well no, and that is what this article seeks to explain.

Issuance and Inflation

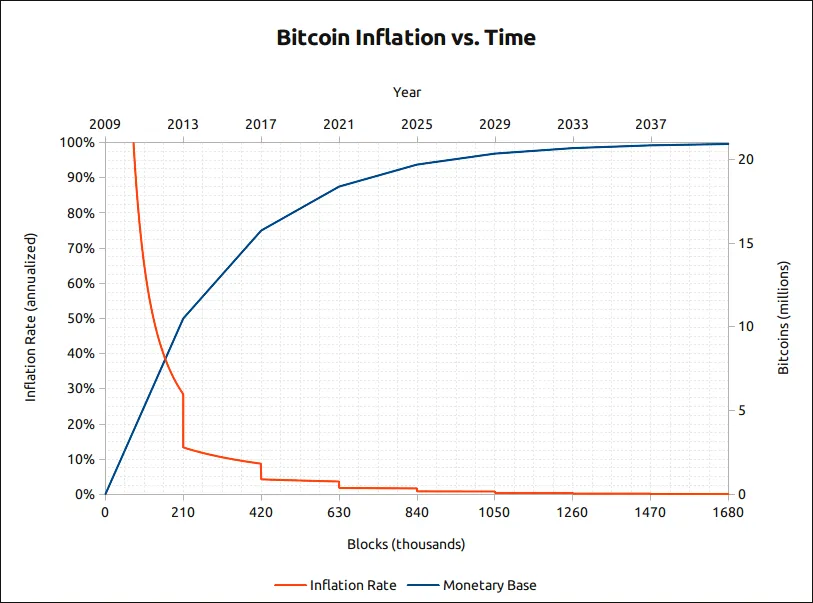

In most cryptocurrencies, issuance and inflation are the same, and this I think is where the confusion lies. Take for example Bitcoin. Bitcoin has an issuance algorithm where every block is allowed to create a certain amount of new Bitcoin and allocate it to any address they choose. The transaction where this happens is called the "Coinbase transaction", and it is usually divided among addresses belonging to miners in a mining pool. Every 210,000 blocks, the amount the miner is allowed to reward halves, and if you draw this out on a chart, you get the issuance curve.

In Bitcoin this issuance is completely the same as inflation - because aside from a short 100 block delay, the coinbase transaction is spendable Bitcoin pretty much immediately.

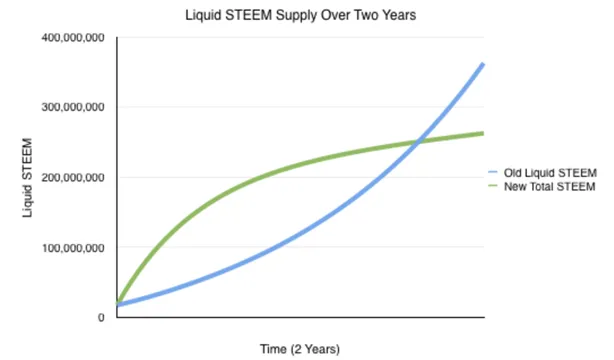

Here is the issuance curve of Steem, post Hard Fork 16 which changed it (green line not blue line). The same issuance curve is used in Hive.

Note again, the actual supply was much higher than the chart predicted. At the end of 2018 there was 283 million Steem and 307 million Virtual Steem - millions more than the chart suggests 2 years after the fork.

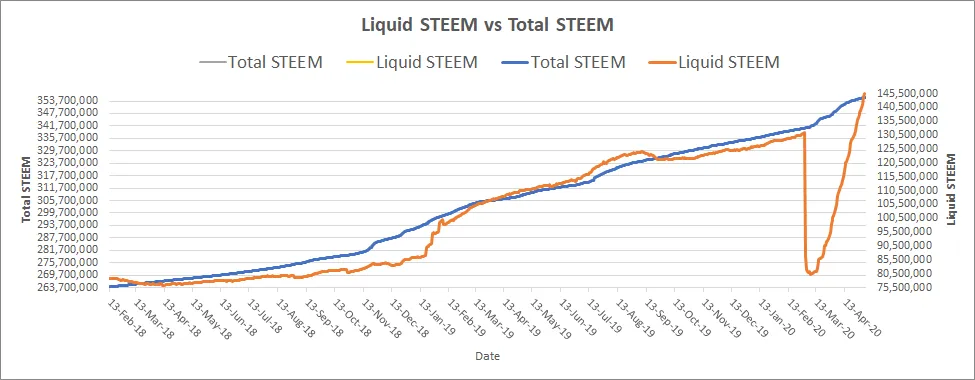

Here is a chart of actual supply on Steem by @socky since he started collecting the data in mid 2018 (blue line in this chart).

Aside from the fact that it's more than predicted, you may notice that it's not a smooth curve as is seen in Bitcoin and most other cryptos. There are periods where it rises faster than normal, the slope of the curve is not consistent, nor is it gradually declining in a smooth fashion. As noted earlier, this is due to the fact that the issuance curve is not the true inflation curve on Steem and Hive.

True Inflation

So what actually determines inflation in Steem and Hive? Well, the issuance curve is most certainly a factor. But you have to understand how issuance works in Steem and Hive to get the other important factors. Steem is not simply allocated freely to whomever the block producer decides, as in Bitcoin. The vast majority is added to the reward fund as Virtual Steem/Hive. Some is added to the vesting fund. Some is added again to the vesting fund for witnesses (with new vesting shares for the witness). And some are created as SBD/HBD for the DAO. When rewards are issued, most again are added to the vesting fund, with new vests as rewards for curators and authors. A portion get converted into SBD/HBD.

It's the SBD and HBD that are key to the difference between issuance and true inflation. SBD and HBD are created at a rate where the collateral value is decided by the price feed. Thus, new virtual Steem/Hive is created in accordance with the issuance curve. However, after that, the virtual Steem/Hive can expand or contract based on the price feed. A lower price of Steem/Hive results in the remaining SBD/HBD converting into a larger amount of Steem/Hive.

When SBD/HBD is converted at a price feed rate higher than they were created at - true inflation is reduced. It will go below the rate defined by the issuance curve. When SBD/HBD is converted at a feed price below the feed price it was created at - true inflation is increased beyond the issuance rate. So the feed price is a factor in true inflation.

SBD/HBD Conversions are not initiated by consensus. They are initiated by individuals based on a pursuit of profit. Profit is higher when the price of SBD/HBD is lower, which tends to also be when the price of Steem/Hive is lower. More conversions happen in a bear market, and for this reason, Steem/Hive inflation gets worse. There is no corresponding decrease in a bull market, because there are fewer conversions. People wait for the price of SBD/HBD to be low before converting. Indeed, more SBD and HBD are created at the higher feed price - further increasing the pressure for high inflation later.

Conclusion

The extra factors that deterimine true inflation are the feed price at conversion and the price of SBD/HBD. The reason Steem has had more inflation since the fork is because it has been more attractive to convert SBD, at a lower feed price than for HBD. There is nothing fundamentally which will bring the supplies back into alignment, as long as Steem continues to have a lower price, and as long as SBD gets converted, Steem is likely to have more inflation than Hive going forward.

There is a long term expectation that true inflation will be higher than the issuance curve for both Steem and Hive, but it may be worse for Steem.

Other factors not discussed: burning Steem/Hive with @null