With the current situation with LUNA/UST and the unbelievable implosion that is happening there, its important to be aware of the HBD mechanics and how things work around here.

For every HBD holder it is very important to know that HBD is set to deppeg and loose its peg to the dollar by design. It is in the HBD design to drop in price if the debt of the blockchain is too high and exceed the limit that is set in the code.

Since the debt is what determines will HBD holds its peg or not lets take a closer look how exactly it is calculated, because as many things around Hive it is not exactly a straightforward thing.

HBD is considered debt on the main token, because in theory all the HBD can be converted back to HIVE, increasing the supply.

How Is The Hive Debt Calculated?

The formula for the Hive debt is as follows

DEBT = HBD in circulation / HIVE Market Cap

This looks quite straight forward, but it is not. It only has two elements, what can be so different 😊.

HBD In Circulation

First the HBD.

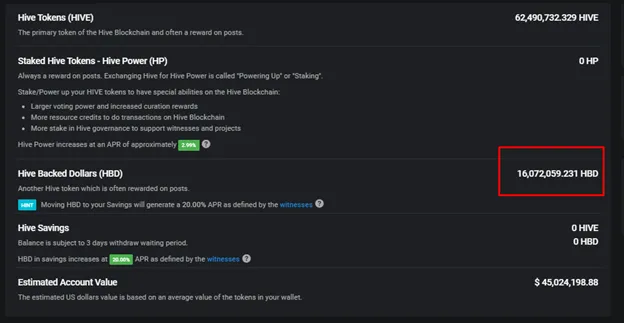

If we go to the Hive block explorer and check the current HBD in circulation we will find this

A 25.1M in circulation at the time of writing this post. But!

The HBD in the DHF (@hive.fund) wallet doesn’t count when the blockchain is calculates the debt. HBD in the DHF account is considered as not available freely on the market, and only when it leaves that account as a proposal payment it becomes available in the circulating supply.

At the moment of writing this the HBD balance in the DHF is at 16,072,059.

When we subtract this from the total HBD supply of 25M, we get a 9.06M HBD if circulation that are used to calculate the debt.

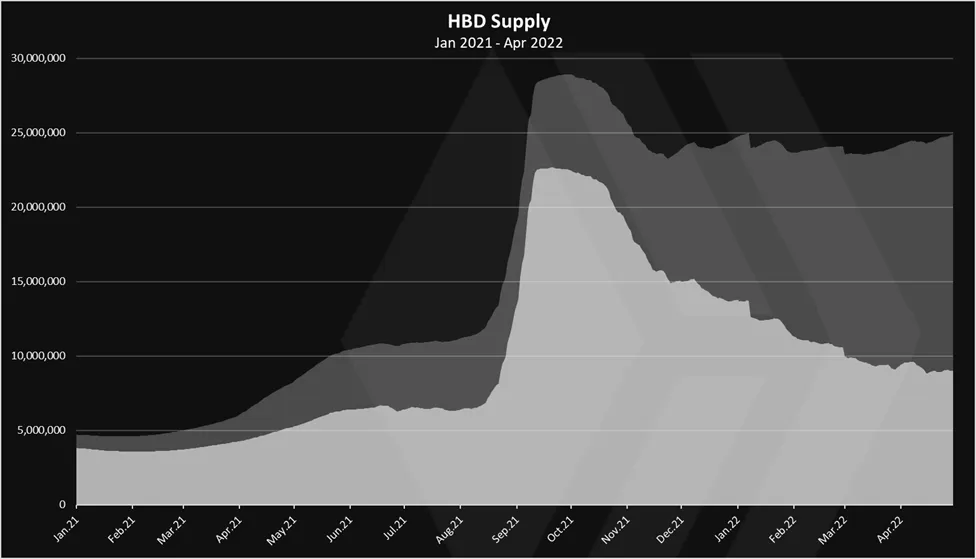

The light color is the HBD in the DHF.

HBD in circulation = 9.06M

Hive Market Cap

The second element from the formula above is the Hive market cap.

Again, the Hive market cap that is used to calculate the debt is not the one that is displayed on the standard coin aggregators like Coingecko.

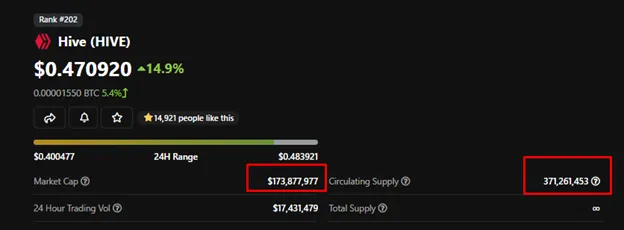

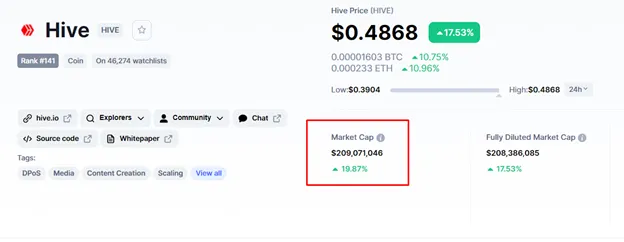

At the moment of writing this this is what is show on Coingеcko.

Coingecko is showing a circulating supply of 371M HIVE, a 0.47$ price, and a market cap of 173M. I really can’t tell how Coingecko gets its supply for HIVE since it is at 371M, while the current supply is at 380M. They say that tokens that are locked in wallets for governance like the DHF are excluded from the supply. But even if we go with this approach there is 62M HIVE in the DHF now, so that will be a 318M, not the 371M as they show.

Coinmarketcap on the other hand takes the virtual Hive supply when calculating the Hive market cap. The virtual supply now is around 429M, so the market cap on the CMC is bigger than the one on Coingecko.

Ok, that is how the coin aggregators are doing it when it comes to market cap. But how is the blockchain doing it?

First the formula for the market cap.

Hive market cap = HIVE supply X Price

HIVE Supply

First let’s take a look at the supply.

When calculating the supply for the debt, the blockchain takes into account the virtual HIVE supply. This is the HIVE supply plus the theoretical HIVE that can be converted to HIVE from the HBD.

HIVE virtual supply = HIVE supply + HBD supply / HIVE feed price

HIVE virtual supply = 380M + 25.1 / 0.5 = 430M

Now what is interesting here is that the formula above takes into account the HBD in the DHF as well. Maybe in the future this should be changed and the HBD from the DHF should be excluded when calculating the virtual HIVE supply. This is in correlation with the HBD in circulation method showed above.

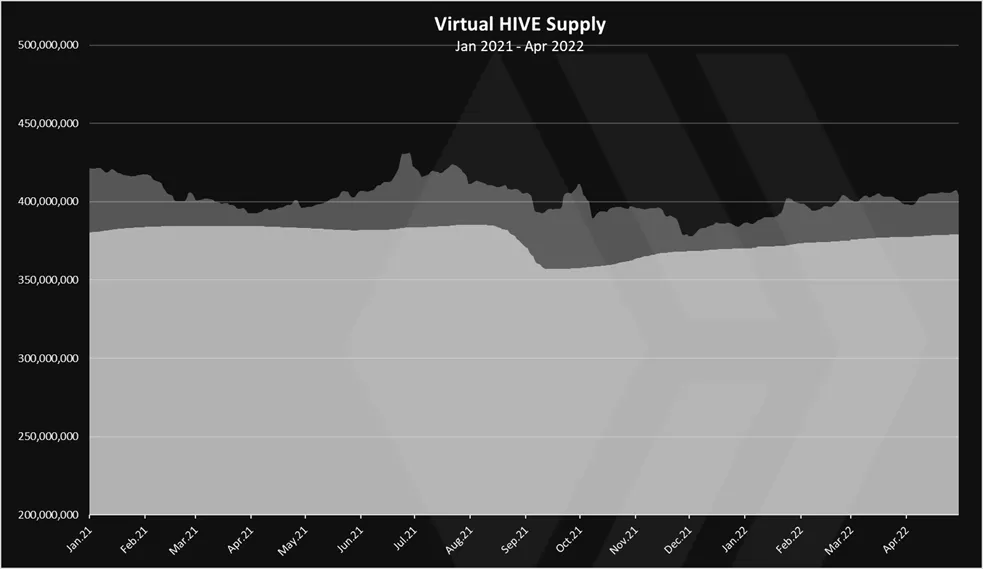

The chart for the HIVE supply looks like this.

The light color on the top is the additional virtual supply from the theoretical HBD to HIVE conversions.

Note that this is a situation until the end of April, May is not included yet.

HIVE Price

Yet again, when calculating the debt, HIVE price is not the same as the market price. It is the HIVE Feed price that is being used to calculate the market cap for the debt.

So, what is HIVE feed price?

HIVE feed price is the 3.5 median price from all the submitted entries from the top 20+1 witnesses in that period. This price usually lags behind the market price. This is the price that is used for many blockchain operations as the HIVE <-> HBD conversions, debt calculations, posts payouts etc. It is the price oracle for the blockchain. It is used for the calculation of the market cap for the debt as well.

At the moment the HIVE feed price as presented on hiveblocks.com is at 0.5, while the market price is at 0.47. This is not that big of a difference, but in volatile times this difference can be bigger. Yesterday for example (May 12, 2022) the HIVE market price was at 0.4, while the HIVE feed price was at 0.6. A 50% difference.

This median price act as a sort of a buffer for the system and exclude the extreme market volatilities that can happen in crypto. It slows the system down a bit but gains security. For example, the one day printing for LUNA in trillions couldn’t happen here just because of the 3.5 HIVE feed price. The price for conversions wouldn’t collapse as fast as the market price, avoiding extreme levels of inflation. There are other important factors that prevent death spiral for HBD and HIVE, especially the debt limit, but the price feed adds on top of them.

If we take a look at the Coinmarketcap, that takes into account the virtual HIVE supply, same parameter as the debt calculation on chain, the market cap for HIVE is 209M, while for the same supply the market cap on hiveblocks.com at the moment of writing this is 215M. This is because of the difference in the price, 0.48 market price, VS 0.5 feed price.

Debt calculation

As we can see from the above three main parameters are taken into account for the debt:

- HBD in circulation

- HIVE virtual supply

- HIVE Feed price

All of the above are different on the blockchain from the usual ones that the coin aggregators report.

When we apply the above we get this:

DEBT = HBD in circulation / HIVE Market Cap

DEBT = 9.06 / (430M * 0.5) = 4.2%

A 4.2% debt as of today, May 13, 2022.

Yesterday the debt was at 3.6%, but with a HIVE feed price of 0.6. Today that feed price has dropped to 0.5.

If the debt level reaches 10%, the blockchain will no longer gives 1$ worth of HIVE for the conversions, ergo HBD will lose the peg.

How much can it go down?

For example, if the debt is at 11%, the HBD price from the blockchain will be at 10/11 = 0.909. If the debt is at 20%, the HBD price from the blockchain will be 10/20 = 0.5.

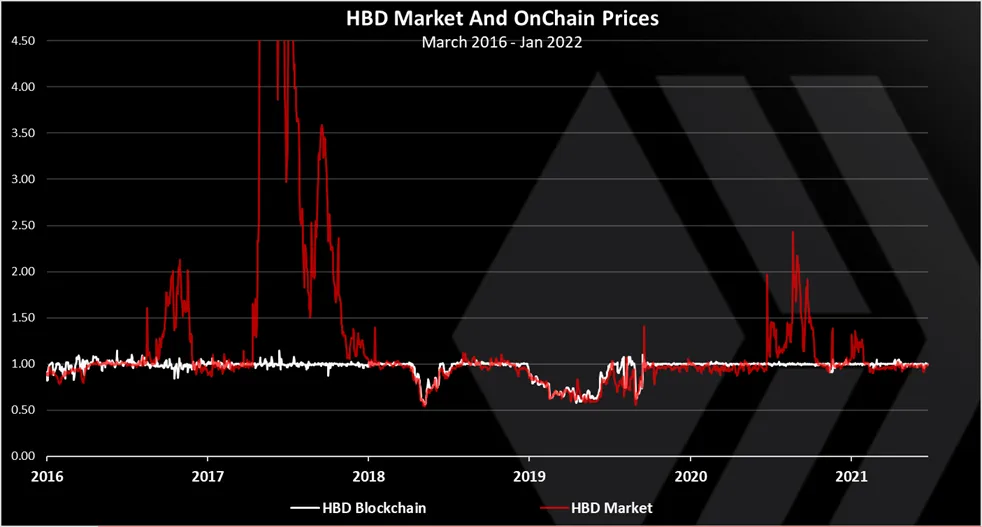

At the end a notice that HBD, formerly SBD was created in 2016. A full seven years now. It has been battletested through bear market. It has broken the peg on the downside two times, once in December 2018 and lasted a month. The second time in August 2019 and lasted six months. The lowest it went was around 0.6$

Note that in that time there was much less fundamentals around the chain. Less apps using it, no DHF funds, no stabilizer etc. Still HBD is designed to break the peg to prevent death spiral and in extreme bad situations this can happen again.

Live data here:

https://hive.ausbit.dev/hbd

All the best

@dalz