Modified banner from this article

Acala has done more than other generic Defi protocols with the creation of aUSD stablecoin

Earlier, I thought Acala that’s a prominent parachain in Polkadot maybe cool because it’s a trusted DEFI platform, but now I see Acala’s vision has been much more than being the usual DEFI product out there with the usual functionalities of being rewarded for providing liquidity and giving you staking yields.

Acala’s main criteria is on bringing a standard decentralised stablecoin for the entire Polkadot ecosystem, with their aUSD, Acala Dollar. This did happen as aUSD entered the Acala Platform, with that being one of the features introduced phase by phase when Acala launched on Polkadot and was getting operational phase by phase.

Now, Acala has got support of 9 leading Polkadot parachains - Moonbeam, Manta, Astar, Centrifuge, Parallel Finance, Efinity, HydraDx, OriginTrail, Zeitgeist to participate in initiatives to grow aUSD’s utility in the Polkadot ecosystem.

I find it incredible that Acala has made a important product, a decentralised stablecoin that looks positioned to be accepted as a standard for the Polkadot ecosystem. It’s a great start, where aUSD can become the foundation stablecoin currency powering the whole Polkadot ecosystem.

Major Polkadot parachains collaborate to drive aUSD’s usage in Dapps

These major Polkadot parachains(mentioned above) have collaborated together to support the growth of aUSD’s usage in their Dapps on Polkadot network.

One way is through making provisions for aUSD to be used in their Dapp products with liquidity pairs for aUSD and yield incentives for aUSD stablecoin.

Funding Startups that are creating products driving aUSD’s utility

However, these major parachains of Polkadot are doing more to drive growth of aUSD’s usage in the Polkadot ecosystem by being trusted partners of Acala along with other venture funds for the launch of the 250$ million ecosystem fund that Acala established to fund early stage startups or parachain teams that are building Dapps driving a strong use case for aUSD.

These Dapps can be in Polkadot or Kusama, can be substrate based or solidity based EVM compatible Dapps functioning as - DEXs, money markets, derivatives, asset management, DAOs, payments platforms or having other functions but must drive strong utility or yield for aUSD.

The fund will also support early stage teams building infrastructure and tooling products, wallets that equip the public to make use of aUSD in their transaction activities when using Dapps.

So, there is a lot of support for Acala’s developed aUSD stablecoin to become the native, decentralised stablecoin of the Polkadot ecosystem.

Some balancing work for aUSD minters to maintain value of minted aUSD

Personally, I would prefer a stablecoin like UST or our own Hive Blokchain’s HBD where the work to maintain the stablecoin’s peg is happening though established mechanisms and I don’t need to worry about anything.

With aUSD, if I choose acquire it through minting, where I put my reserve crypto as collateral to mint aUSD, it’s risky because my crypto collateral can get liquidated when its value declines in price, this is because aUSD is a decentralised, over-collateralized stablecoin.

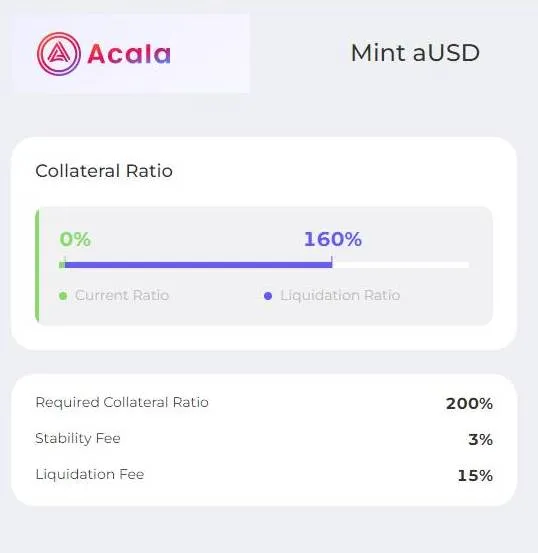

aUSD seems to be a very over-collaterised stablecoin! in Acala

I have explained in my previous article, that collateral that’s 200% more than the minted aUSD value has to be deposited for minting aUSD and when my collateral value declines being 160% more than the minted aUSD value, then it’s subject to liquidation.

So, it’s some work balancing the minted aUSD coin during price declines.

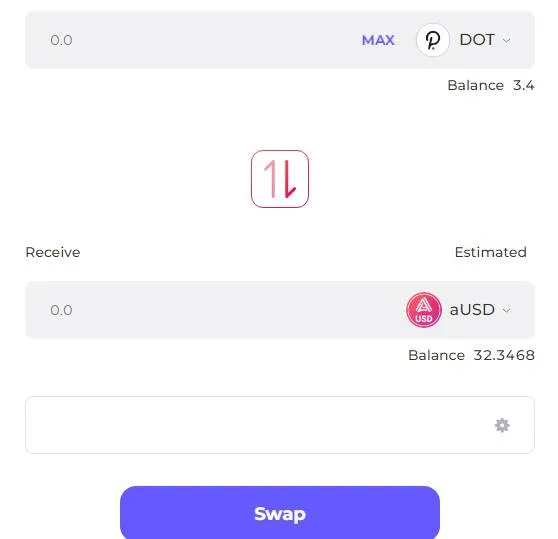

Anyway, luckily, you can acquire aUSD coin by buying or swapping it rather than minting, so you are not subject to the danger of liquidation of your collateral. So, perhaps this way one may choose to obtain a nonvolatile decentralised aUSD coin.

Good that aUSD stablecoin can be purchased in Acala by swapping

Uniqueness of aUSD stablecoin

A good thing is that we can use major cryptos we have of other Blockchains as collateral to mint aUSD, meaning one can bring their ETH, Fanton, Solana, Luna using wormhole bringe to Acala and use them as collateral to mint aUSD. This makes aUSD a decentralised, cross- chain, over collateralized stable coin.

aUSD can be minted using our otherwise locked Dot, like the Dot that’s locked up in staking or Dot contributed to crowd loans that’s now LCDot whose liquidity we can use to mint aUSD, which is unique as well.

Packaged support along with the The Ecosystem Fund to propel growth of aUSD’s utility

Overall, with this 250$ million ecosystem Fund, we can expect a lot of projects coming up making use of aUSD in their products driving the utility and yield for aUSD.

As besides funding, Acala and its partners give other kinds of required assistance for projects that are selected to be supported by the 250$ ecosystem Fund -:

- These projects can raise capital for product development

- Acala will help them with engineering talent for building up their substrate or solidity based products

- Benefits from injection of aUSD liquidity into these protocols will boost project’s Total Value Locked that is, TVL

- Projects will get networking opportunities with Acala's supporting partners, this will aid in expansion of projects

- Acala will help in promoting and marketing of projects as they launch. This includes support for community building, awareness and education for the usage of the product.

More details can be got from the original announcement and the application page for applying for Acala's ecosystem program here.