The 30% Indian crypto tax law, just got a lot harsher from what we imagined it to be earlier.

Earlier, the Indian crypto tax law that was proposed, had harsh provisions no doubt but it allowed for profits made in crypto to be adjusted against the losses incurred in crypto, but now the wording in the earlier crypto tax provision is changed, and it does not allow for adjusting tax on crypto profits by offsetting losses made in crypto trades.

(Ouch… My jaws are dropping…)

Let’s evaluate how harsh the Indian crypto tax law is.

- 30% flat tax on all crypto profits without exemptions and deduction for expenses incurred like for fees and other expenditures(equipment, electricity etc).

- There is no income slab, you earn any profit on crypto trades, you have to pay taxes.

- 1% TDS on crypto transaction above a threshold, which I heard is Rs 50,000

- Now, add the new change that you cannot offset your crypto losses from your crypto gains.

This means you pay tax on the profits you made, even if you have incurred losses in other crypto trades, losses won't be offset.

Again twitter trended with pleds of the Indian Crypto Community to #reducecryptotax

Obviously, this put off the Indian crypto community and on Friday, #reducecryptotax tag was trending again on twitter but it did not sway the Finance Minister to change the harsh provisions of the Indian Crypto tax.

I have explained what I understood about this harsh Indian crypto tax in my previous articles -:

The hard Indian Crypto Tax season to Rekt the Indian crypto community is starting next month!!

The Indian crypto community lobbies the Government to reduce the grand 30% crypto tax

Entertaining Crypto Proceedings in the Parliament with pro crypto Politicians raising their voices

Now, on Friday, the 2022 Finance Bill was passed in the Upper house of the Parliament (Rajya Sabha) with all these stringent crypto tax provisions.

Still, however tough this news is for crypto investors to digest, at least we can enjoy some entertainment because there are some pro crypto MPs in the Parliament and they spoke out against these harsh crypto tax provisions, and it brought a smile to my face.

I have been thinking there were idiots out there in the Parliament Houses, who don’t give a damn for revolutionary things like crypto, blockchain, Web3 etc but no that’s not the case.

Pro crypto voices from few sensible Indian Politicians in the Parliament!!

MP, Ritesh Pandey says that Web3 industry will be hampered with these harsh tax provisions

Take what Member of Parliament (MP), Ritesh Pandey, explained that a recently made Bollywood movie released a NFT. If that 1% TDS were implemented then it’s promoting Red tapism, because people have to buy ETH and send it to metamask, for which 1% TDS will be detected, then again TDS will be detected when a ETH transaction is made to buy a NFT of a Movie poster signer by a film star.

He also said that Web3 start up companies that are building in India will get destroyed because of the neck strangling costs of doing crypto transactions and that this crypto tax provision is destroying the future of Web3 companies.

These companies will continue building elsewhere just like Web1 and Web 2 giant companies of today Google and Facebook emerged somewhere else in the world but not in India.

He also told the Finance Minister that in the future she herself will remove that TDS provision because of its detrimental effects. He ended by saying, clearly stressed out of time, that he appeals to FInance Ministry to remove TDS and taxes on crypto and not cripple the growth of the Crypto Industry, that is a young industry which the youth loves to engage in.

Here is the video of Ritesh Pandey’s speech..

Applause. I also liked that he told that the Government should give a thought about the crypto investors as these tax provisions are detrimental for us small retail investors, no point crying though…anyway.

MP Pikani Misra says crypto is like internet and Government is ignorantly branding it as a sinful asset

MP Pikani Misra, too spoke against this harsh crypto Bill, saying that now crypto is like the internet and prominent figures like the governor of the Central Bank are calling it hot air. The Government has branded crypto as a sinful entity with all these harsh tax provisions. This will kill the crypto industry.

There needs to be an expert panel to make the crypto bill, which is not yet ready and it's been pending for a year. The digital money which the RBI Governor is introducing is also hot air, if crypto is hot air.

He told that the current crypto tax provision shows utter confusion in the minds of the Government and it’s causing chaos for the crypto industry.

He told that 1% TDS should be made to 0.01% TDS instead.

Applause again and I thank this knowledgeable sir for speaking up for pro crypto tax measures and also the need for experts in the crypto space to be involved in making the crypto bill, as this crypto tax provision that the Finance Ministry has drafted is clearly outrageous… !!

Video Clip of Pinaki Misra's pro crypto speech in Parliament

Well, looks like there were more voices that expressed that the current crypto tax provision has no clarity.

Indian Finance Minister’s response to the issues raised by pro-crypto politicians

The Crypto Bill that is coming is still under discussion in the Consultation phase according to the honourable Finance Minister, Nirmala Sitaraman, but until its ready the Government does not want to lose out on taxes, as a lot of crypto activities are happening in India with lot of cash exchanges about.

She defended the TDS provision, saying it’s for tracking and it's refundable when investor files taxes, nothing about reducing the TDS though.

Can watch Finance Minister’s verdict here in this video clip

There are some more interesting speeches with good points raised by other pro crypto MPs…can’t delve in it, may do a continued post on it tomorrow.

Government is getting good GST revenues from Indian crypto exchanges

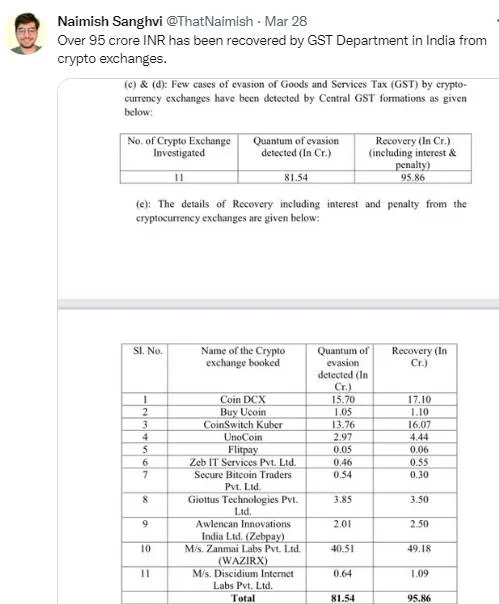

The Government has already been getting good GST revenues from Indian Crypto Exchanges. This tweet shows data on how much the Government has penalised the Indian Crypto exchanges for evasion of tax, and has recovered much more than the claimed tax evasion done by the Indian crypto exchanges.

Tweet GST Tax penalties Indian Crypto Exchanges paid to Indian Government

Whatever it is, now the Indian government are on to penalize small, retail crypto investors for any little gains they make in crypto.

Well, anyway, that is how it is, however ever that sucks, shrugs.

Thank you for reading my post. Have a good day!!